STRK Bull / Bear Analysis

STRK has had a controversial introduction; but emotions can sometimes hinder clear thinking - here is an unbiased analysis on STRK

STRK Overview

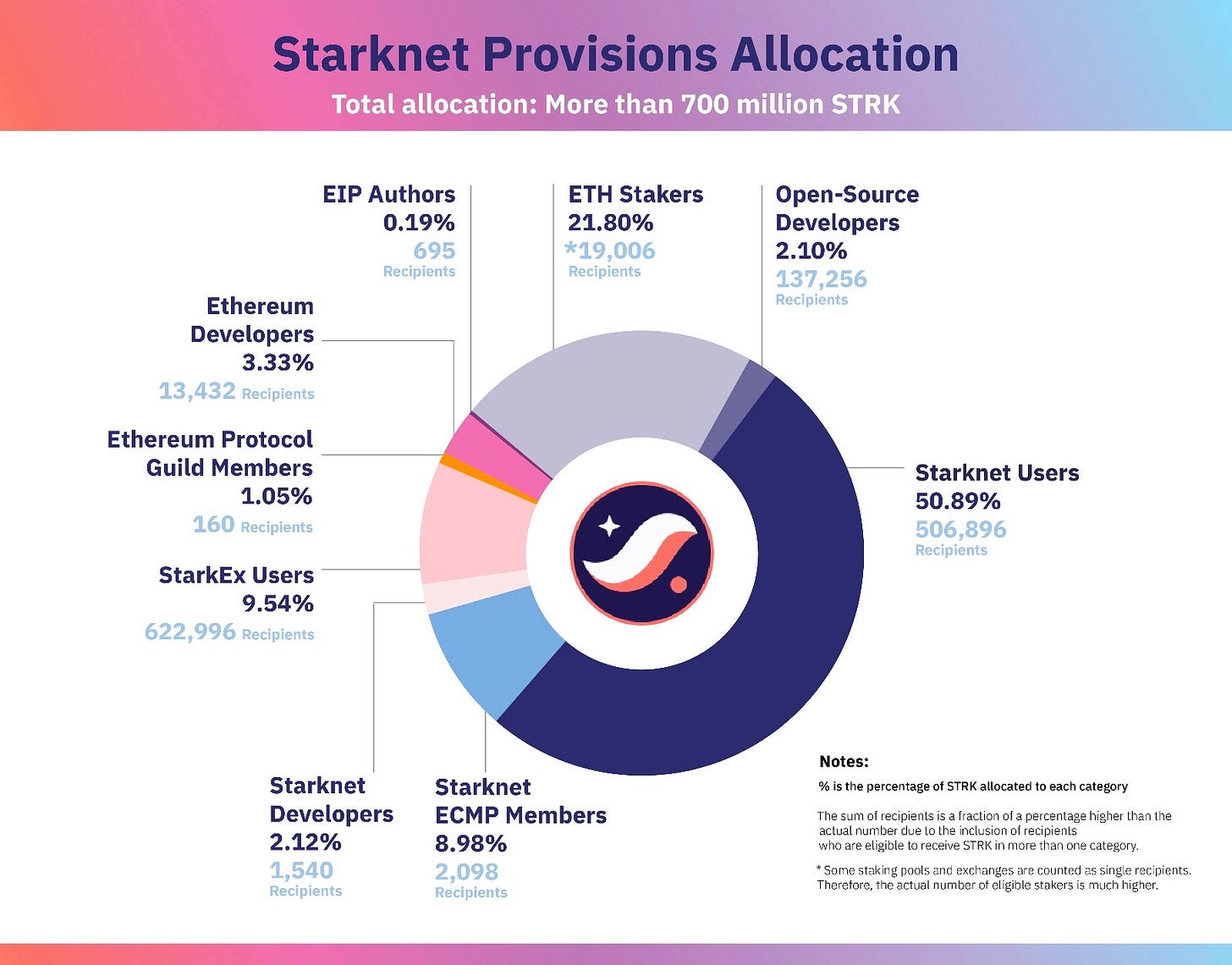

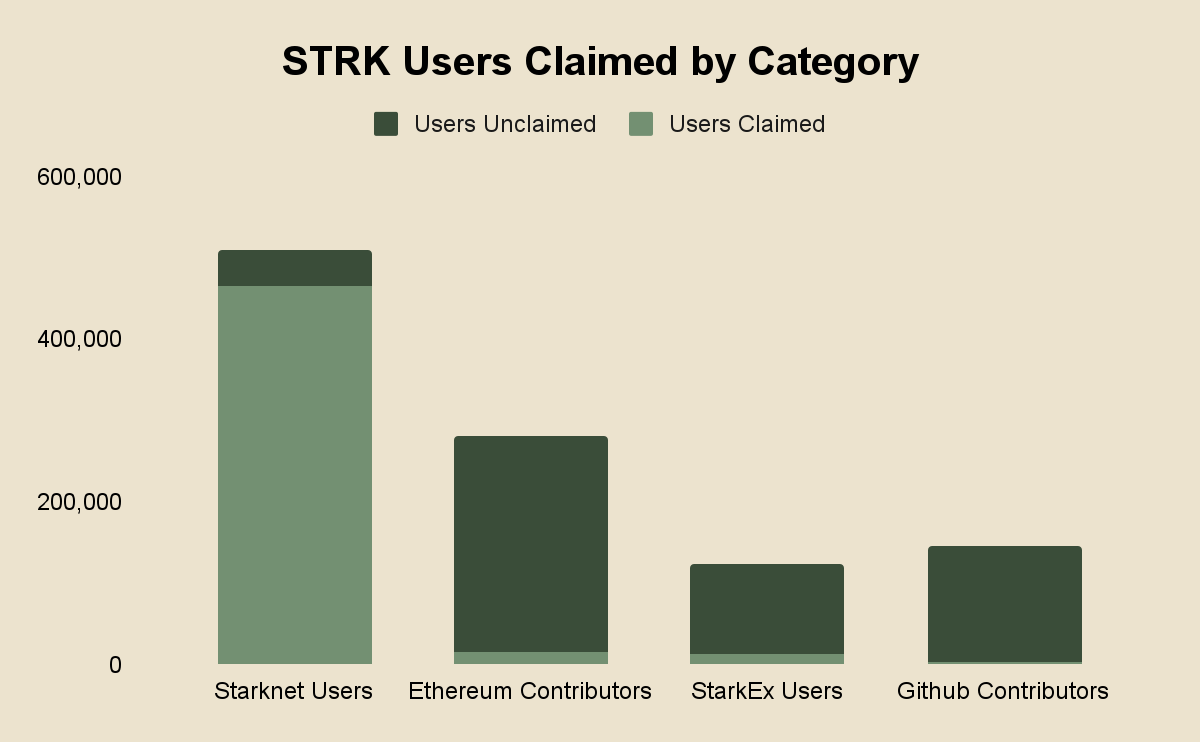

In one of the more controversial airdrops of the current cycle, Starknet launched its STRK token on February 20th - allocating over 700M STRK (7%) to the community. At current prices ~$1.3B was distributed to more than 1.3M users, in the breakdown shown below:

Why was such a large airdrop controversial?

In our opinion, eligibility requirements for Starknet users were heavily skewed towards potential airdrop farmers not actively engaging with the chain. With the snapshot taken in early November 2023, users only needed:

5+ transactions

$100+ in volume

Over 0.005 ETH held by the address

Using only these requirements created an extremely low barrier to sybil, overlooked users that held other tokens on Starknet and punished users that had their assets in applications at the time of snapshot who were actually using the network.

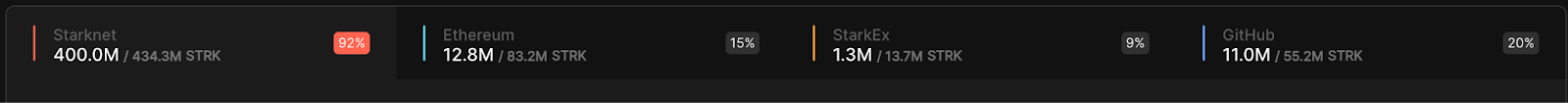

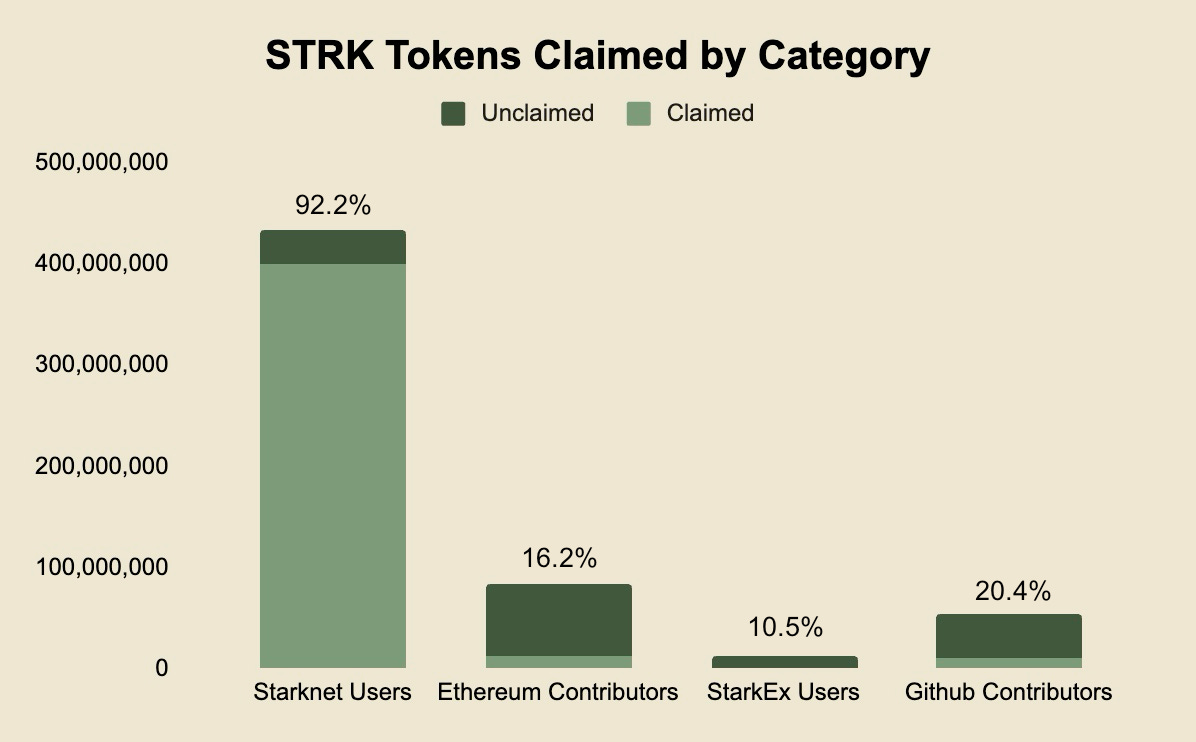

In the ~30 hours after the airdrop was released, 425M STRK have been claimed with a heavy skew towards network users over Ethereum contributors, StarkEx users or Github contributors.

Demand Dynamics:

The STRK token itself is actually novel and pushes the envelope on how layer 2s should integrate their token, while still aligning with Ethereum. Beyond STRK’s role as the protocol governance token, the asset is & will be used in a number of real capacities:

Gas Token: On day 1, STRK is already a whitelisted gas token on Starknet - allowing users to transact without having to hold ETH in their wallet. The Starknet sequencer wallet holds 35,200+ STRK, so assuming that there has yet to be a conversion from STRK to ETH, roughly $70,000 in transaction fees have been paid in STRK rather than ETH. This is a number that likely increases as the foundation plans to create a STRK gas rebate program, where applications will be able to subsidize their users transaction fees via account abstraction.

L2 PoS Consensus: In its current form, Starknet’s state is only “final” after a batch of transactions has been proven on Ethereum mainnet. By creating an L2 Proof of Stake mechanism, a new validator set will be created by staking STRK in order to provide faster finality assurances via pre-confirmations.

Sequencing: Assuming Starknet eventually implements some form of L2 consensus, this will also allow the network to have a decentralized system for choosing a block leader, who will be the effective sequencer of that given transaction batch. L2 sequencing will likely be quite lucrative, given that users of L2s often overpay for L1 blockspace and the sequencer receives that spread. Additionally, decentralized sequencers are likely to reap the upside of MEV on Starknet.

We have yet to see a large layer 2 fully integrate their token into their network, but it will be interesting to see if L2 staking has a similar blackhole effect as we have seen on Ethereum mainnet and most other layer 1 networks. As of today, sequencer margins on Arbitrum, Base and Optimism appear to be limited to roughly 25 ETH per network each day. Assuming Starknet is also able to eventually fall into a similar spot, sequencer margins could land somewhere around $25-$30M annually. Throughout the next year or two, there are multiple catalysts that could cause these margins to explode, including:

Bull market on-chain activity resuming

Decentralized sequencers attracting MEV to L2s

EIP 4844 significantly driving down sequencers L1 posting costs

Supply Dynamics:

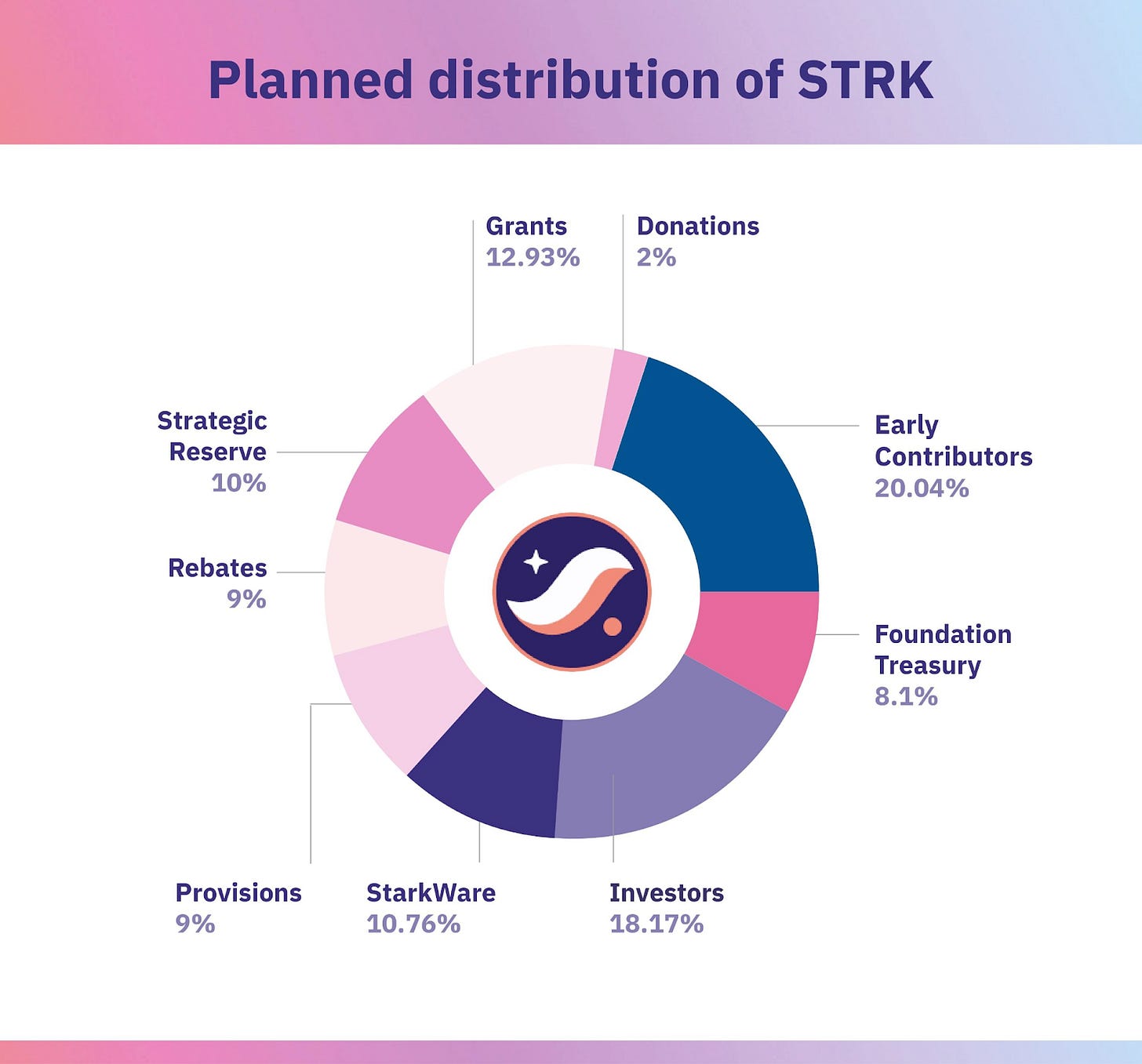

The total STRK supply is 10bn, and the airdrop came from the “Provisions” tab (9%). The provisions provided this round was ~700m STRK (7% of total supply), but only 5.86% of this ~700m was claimable between 4 main categories:

Ethereum Contributors - 83m STRK across 281k users

StarkNet Users - 434m STRK across 508k users

StarkEx Users - 13.6m STRK across 123k users

Github Contributors - 55m STRK across 145 users

It’s important to note that users have until June 20th, 2024 to claim their tokens - otherwise they will be collected and redistributed in subsequent provisions rounds. At the time of writing, 72% of tokens have been claimed. There is also a notable difference between claims by category, but this makes sense given Starknet users were the party likely anticipating this event the most versus the others.

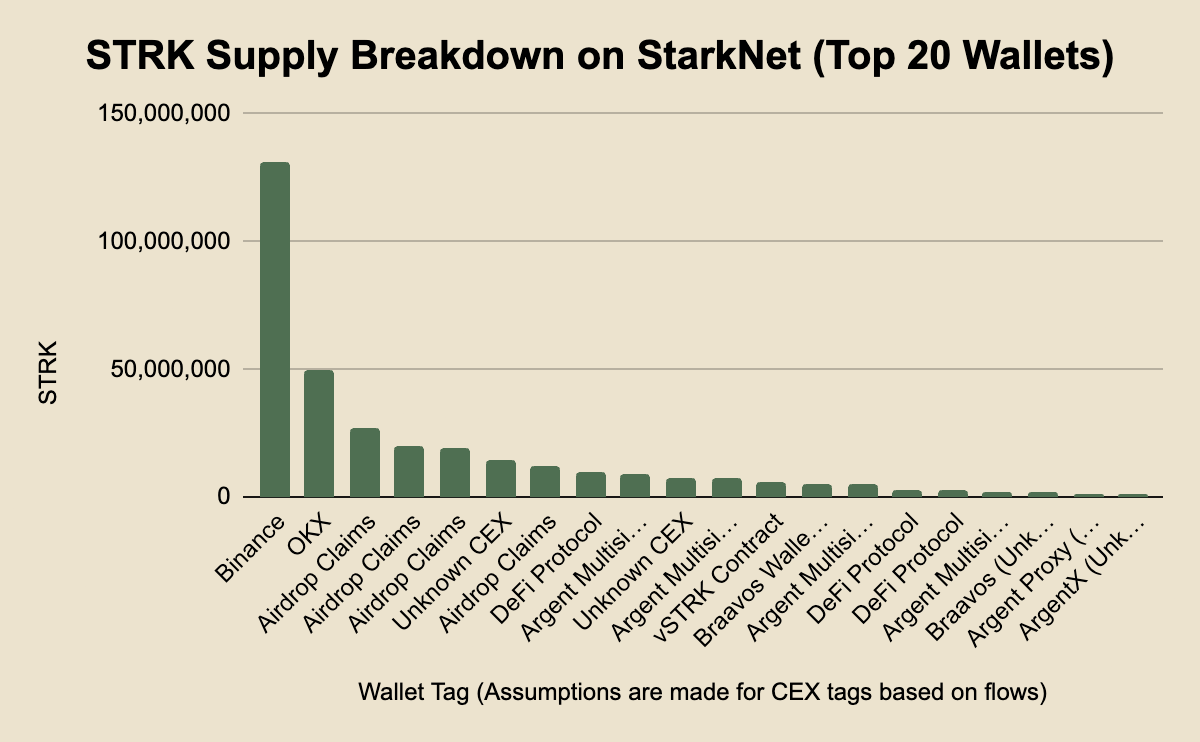

When looking at the onchain breakdown of the supply, it's a bit messy. While the entire STRK supply exists on L1 Ethereum, the token airdrop provisions were issued on the Starknet L2. The onchain liquidity for STRK is decent, but not great with about $8m of pool liquidity across ETH-STRK & USDC-STRK pairs on Ekubo, the chain’s largest DEX with a TVL of ~$20m.

The CEX listings of STRK came with an important caveat - Binance, OKX, Kraken, HTX (Huobi), ByBit, and KuCoin support the Starknet network, but Coinbase and BitThumb only appear to support the Eth L1 version of STRK. This was an interesting move to see so many CEXs have the mainnet integration ready to go, and may lead to better network effects for Starknet as users can deposit<>withdraw directly to and from Starknet.

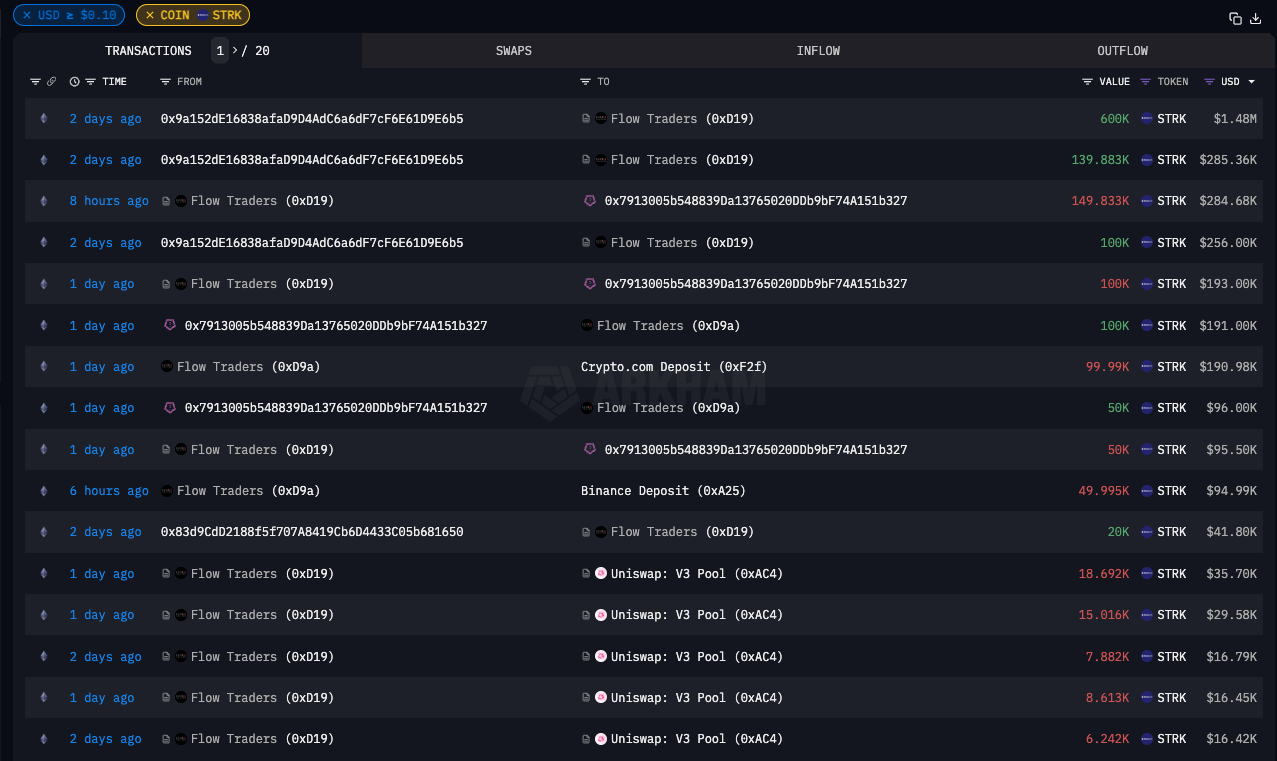

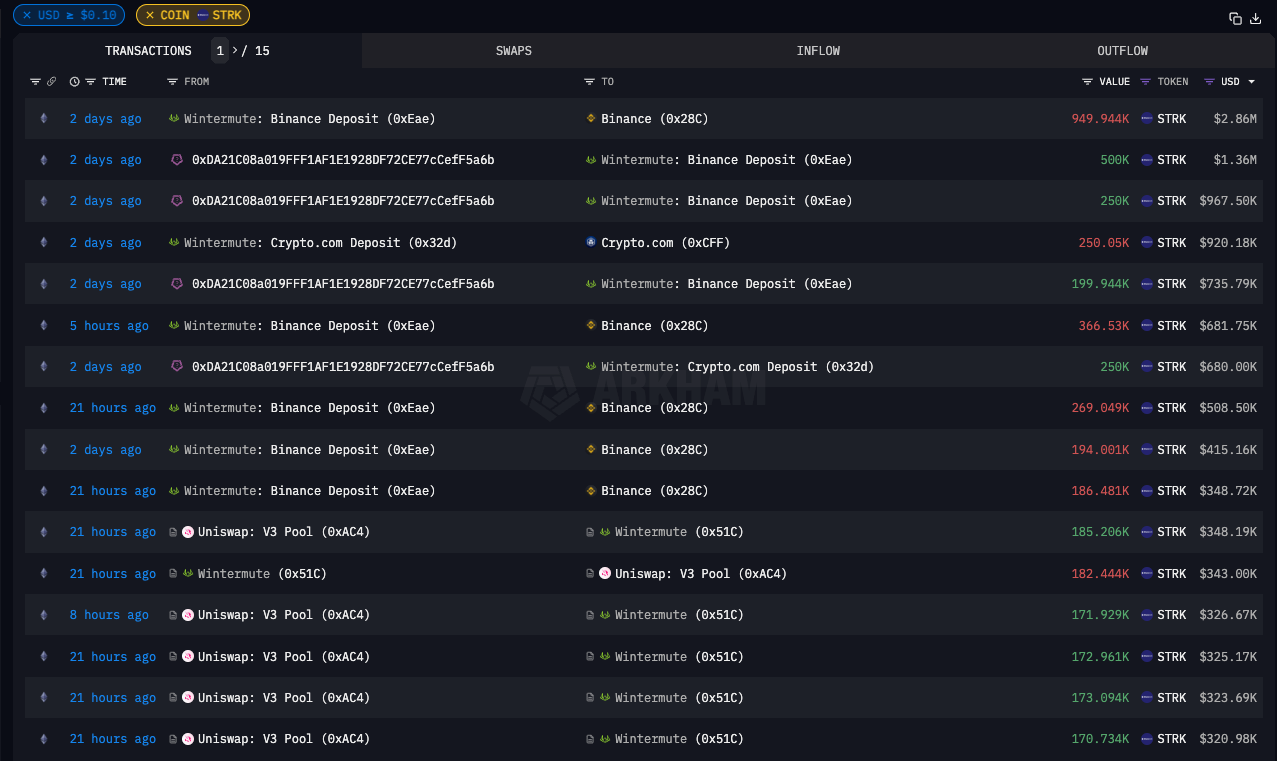

The Eth L1 flows for STRK are mainly dominated by Flow Traders & Wintermute who appear to be the designated market makers for STRK, given their large deposits to Binance & the UniV3 pool.

So, where is the remaining amount of STRK? 586m was allocated to the claimable airdrop “provisions,” and it appears the remaining STRK is between the ECMP (Early Community Member Program) & the Starknet developer allocation, and lastly the ETH staker allocation. It is unclear exactly when these tokens will be distributed, as some of them are at the discretion of exchanges for the ETH staker allocation.

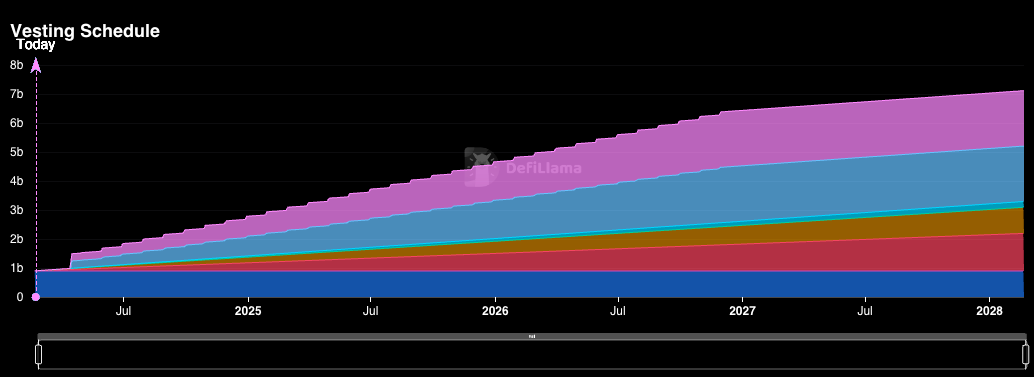

Before we dive into the bull and bear case analysis, let’s take a look at the supply schedule.

One unique thing about STRK is there will be notable unlocks for both early contributors to the network and investors, which will begin to take place on April 15th, 2024. Between those two parties alone, 64m STRK ($129m at current prices) will be unlocked.

Given Starknet has been building for so long and has raised multiple venture rounds, there are some key investors which are no longer around: 3AC & Alameda Research. Both parties participated in Starkware’s series B funding round of $75m, with both following on in the $50m series C round, and then 3AC contributed one last time in Starkware’s $100m series D.

According to Arkham Intelligence, Teneo, the firm responsible for handling 3AC’s bankruptcy process, seems to have 1.34% of the STRK supply ($272m at current prices). It’s unclear exactly when all of this will be vested, but for both 3AC and Alameda alike - their amounts are likely to be sold at a deep discount via OTC or onto the open market as their respective cliffs hit. Likely the latter given the incentive structure around bankruptcy liquidations. Objectively, the vesting cliffs for STRK are some of the most aggressive we have ever personally seen in the space.

- Now, let’s explore the Bull and Bear case for the STRK token.

Bull Case

Markets are heating up and crypto valuations seem to be in a discovery phase, with the likes of Celestia, Worldcoin and Eigenlayer resetting investors expectations. Looking at current metrics and multiples for Starknet may not warrant its current valuation, but looking down the road there are several catalysts that could signal where we are headed:

The Ethereum roadmap is designed for rollups, activity will slowly continue to drift to L2s as users are priced out on mainnet

Increased activity leads to further value accrual through sequencer margins and eventual MEV on L2 DeFi applications

Starknet has made a push to enable native ETH staking through Lido via their L2, a move that should even the playing field with mainnet even further

Starknet’s Account Abstraction experimentation is likely to create a much more user friendly platform, something we have yet to see across other L2s

STRK is an early leader is actually integrating their token within the ecosystem, not following the standard “useless governance token” route

To go deeper on that 3rd point, the staking mechanism which was covered in the demand dynamics section could potentially absorb a notable amount of the overall circulating supply if the mechanics are sound enough. If tens / hundreds of millions of dollars in fees are being paid in transaction fees on Starknet, validating the network becomes quite lucrative, inviting market participants to buy STRK and stake in order to reap the benefits. Further, allowing STRK to be used as a gas token could drive consistent demand over the long run given sustained network usage.

Additionally, with the market momentum STRK has been birthed into, coupled with the inherent network utility, Starknet itself has the opportunity to be completely built around STRK. We are already seeing this now, albeit we are in the very early stages, but the ultimate sign of STRK dominance would be seeing the largest swap pools across DEXs being denominated in STRK rather than ETH. Note that in this case, if STRK catches a sizable bid then the TVL is reflexive to the upside, potentially catalyzing a notable amount of user activity and builder attention.

Lastly, let’s consider the airdrop allocation as a bullish thing. Yes, the amount of STRK allocated to users and the total amount airdropped in general fell below the benchmark of its peers, but this could be flipped to serve as a demand driver for further Starknet usage given there are plenty more tokens yet to be distributed back to community members. Especially if STRK can maintain its relatively high valuation during these unlocks, then the opportunity cost of not transacting or building on Starknet increases. When it comes to strategy, imitation won’t deliver outsized returns, and it can pay off to take risks in your differentiation.

Bear Case

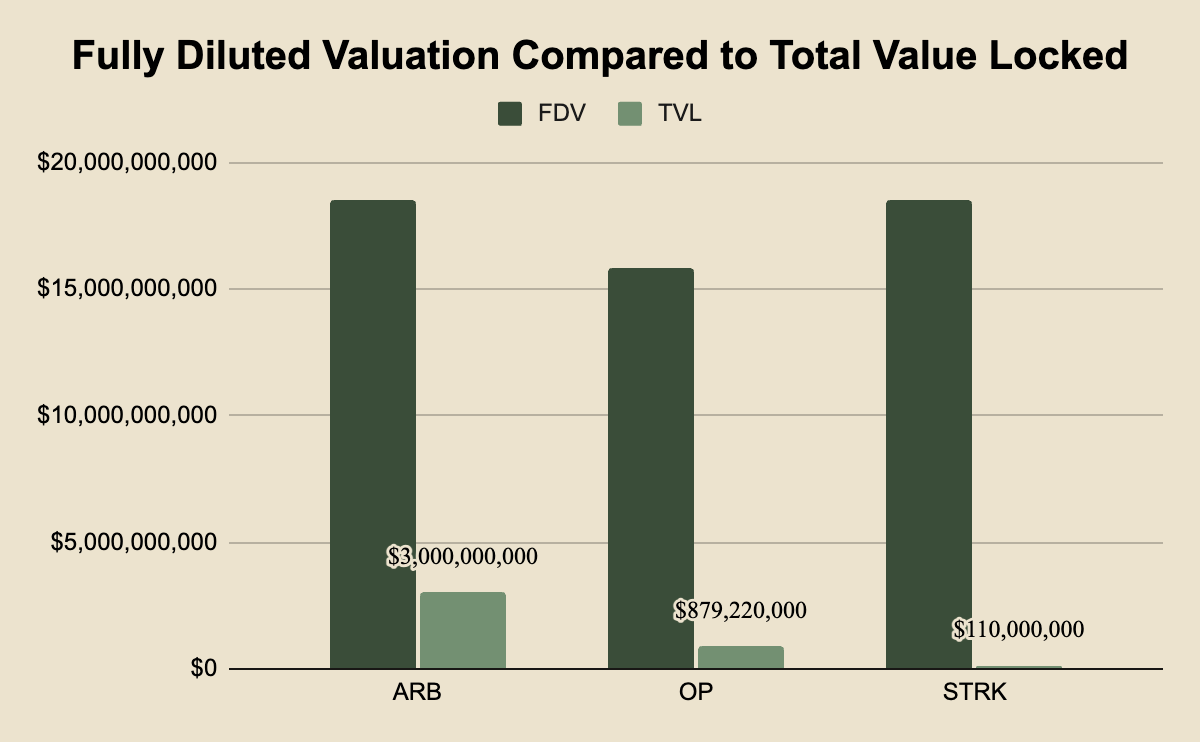

STRK is currently trading at an $18B fully diluted valuation, on par with $ARB and significantly higher than $OP - both of which are by far the largest Ethereum L2s in terms of TVL and total accounts. It’s reasonable to question how Starknet deserves a similar valuation, while currently having $110M in TVL, less than 3.7% of Arbitrum’s value locked. To put things into perspective, Metis, another layer 2 with ~$65M in TVL is currently valued at ~$870M, fully diluted. However, it is still very early for Starknet and TVL is an imperfect measure - the metric will probably be up only over the next several months, in fact it doubled overnight due to STRK’s integrations into DeFi protocols.

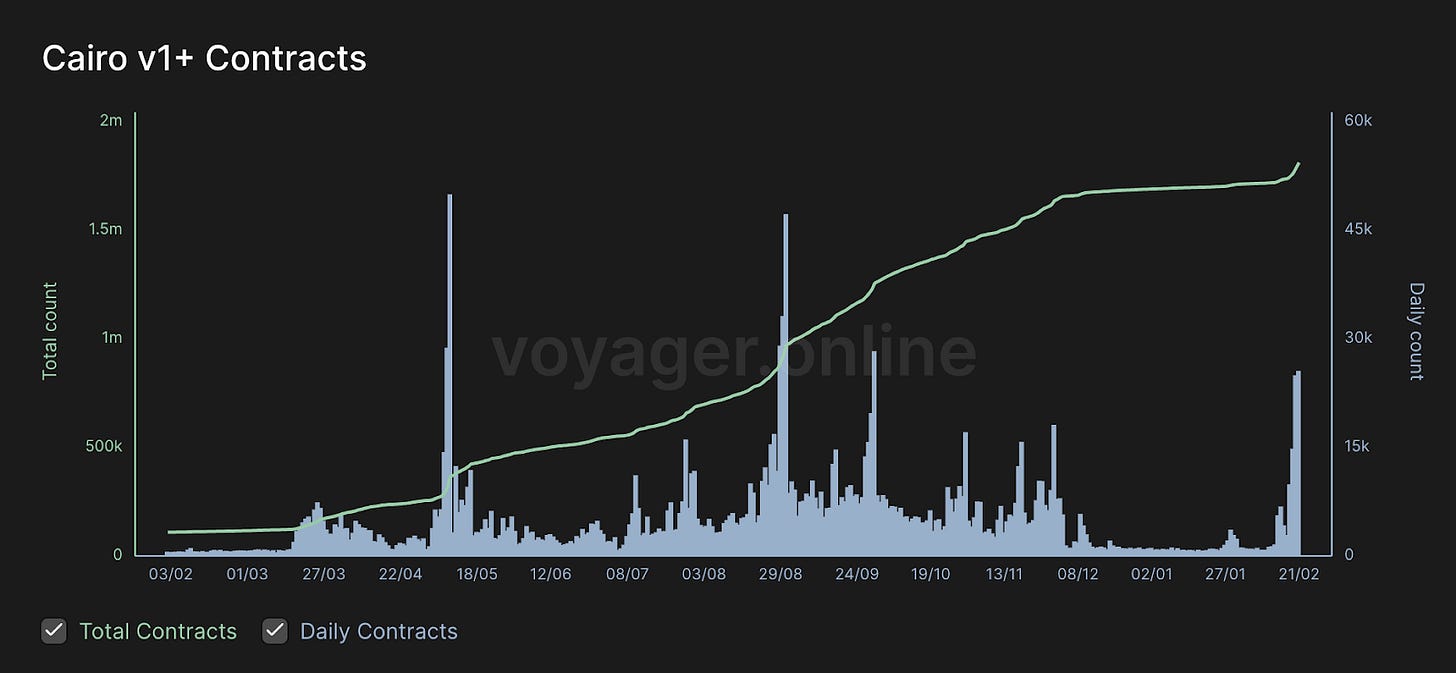

It’s also notable that development activity on Starknet appeared to slow down significantly post-snapshot, with daily contract deployments in December and January falling to their lowest levels since launch. Activity will likely come back with token incentives and returned user interest, but it would be very worthwhile to watch nonetheless. As of today, a majority of the largest applications on Starknet are recycled DeFi primitives, which are important especially while building an ecosystem - but Starknet has yet to find its “killer dapp” that is exciting enough to drive new users.

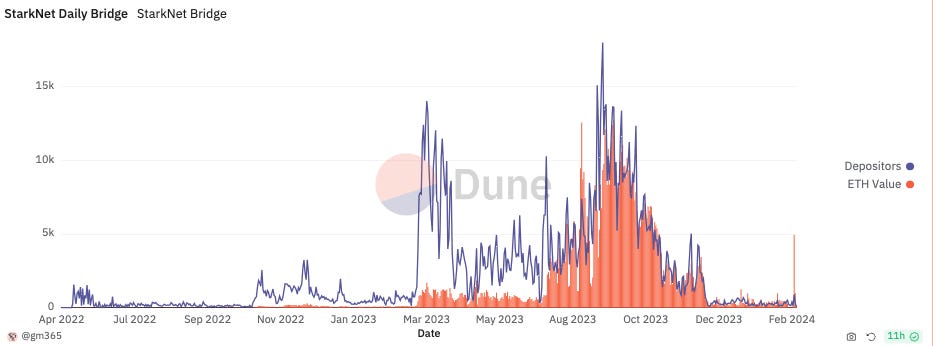

Further, the amount of ETH bridged to Starknet slowed dramatically leading into the airdrop announcement. However, as mentioned earlier, the new STRK liquidity injection could potentially have positive second and third order effects.

Finally, issues with both the airdrop & vesting schedule have undoubtedly cast a shadow over Starknet, forcing the team to work uphill to regain user trust and excitement, especially through large unlocks in the coming months. Fortunately, the crypto industry has a short-term memory, so nothing is permanent and Starknet could very easily find ways to retain and build its community over the next several months.

Concluding Thoughts

There are some interesting differentiations that the Starknet team has made, but the elephant in the room is that investors' cliffs are less than two months away, on April 15th. Realistically, there is just not enough liquidity for these investors and early contributors to exit. As it stands today, there is roughly ~$4m of liquidity across the top exchanges. You can do some simple arithmetic and note that everyone trying to exit once is simply not possible and would lead to a tragedy of the commons type scenario. Personally, we think it is more +EV for investors and early contributors to put their tokens to work on the network, lock them in some DeFi protocols, give out some personal grants, show some real skin in the game and effectively grow the pie. Of course, we realize this is easier said than done. Most VC funds are not mandated to participate onchain, but there were a number of individuals that contributed in earlier rounds and are up huge. If anything it would be cool to show you believe in the network you invested in by *actually* using it. We do realize that most investors are purely profit oriented, but given the situation, it would be interesting to see something different than the typical unlock + dump situation.

The devil will be in the details, as it is unknown how the Alameda & 3AC bankruptcy estates plan to exit (i.e when they will sell and who they will sell to). It’s entirely possible that they have already signed their rights away to other venture funds with longer term horizons, at a discount. Ideally, investors will not be watching their vesting schedules too closely as there is clearly an opportunity to build something around Starknet. In the event that the investors, developers and the community are able to align incentives - value is bound to accrue back to the STRK token. However, if we see any form of misalignment and investors race to the exits, we could see a reflexive downward spiral and it will be difficult for Starknet to build a new ecosystem from ground zero.