Solana’s Surge: Pushing the Limits of Speed, Markets, and Scale

Solana's bounce-back to become the leading chain across multiple key metrics might not have a parallel in crypto history.

This report is also available in PDF format here - thanks to our friends at the Jito Foundation for the lovely design work!

1. Executive Summary

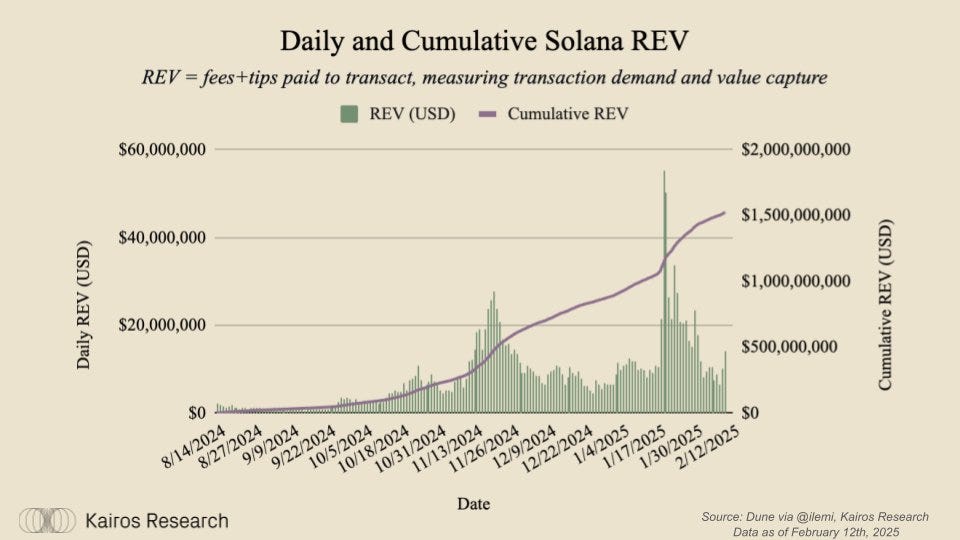

Solana’s resurgence from its lows in December 2022 has been nothing short of a paradigm shift, and it is now leading in key metrics like decentralized exchange (DEX) volume, aggregate protocol revenue, and real economic value (REV) generated. Solana is redefining how blockchains scale, capture, and distribute economic value. With memecoin speculation driving unprecedented on-chain activity and groundbreaking infrastructure upgrades like Firedancer set to push performance beyond 1M TPS, Solana is cementing itself as the premier high-speed, high-efficiency network for the next era of crypto adoption.

In this report, we’ll dive deep into the driving forces behind Solana’s surge in activity, and how these drivers are shaping its overall positioning as the premiere growth opportunity for investors. We aim to provide the most important data on Solana’s growth, allowing readers to see key trends in the ecosystem and form their own narratives around Solana.

Key Takeaways:

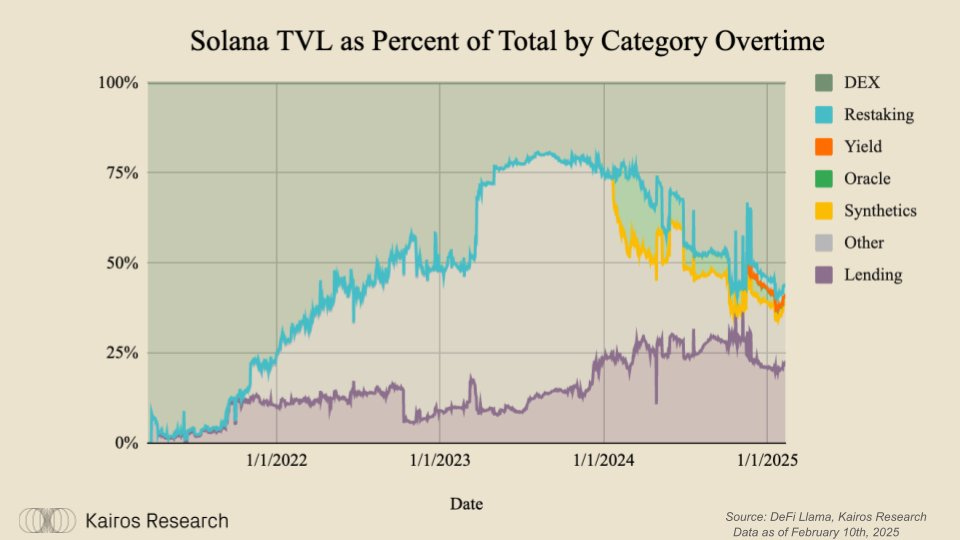

Solana’s Market Rebound: Solana’s resurgence from the FTX collapse was fueled by price reflexivity, major airdrops like JTO and JUP, and a categorical TVL concentrated around trading, highlighting its ability to attract and retain liquidity.

Trading Over Yield Farming: Unlike Ethereum’s DeFi growth driven by yield farming, Solana’s surge has been led by high-frequency trading, memecoins, and low-fee transactions.

Jito’s Critical Role: Jito has optimized Solana’s MEV landscape, securing 90% of network stake, distributing over $1B in MEV tips, and enabling sustainable validator incentives.

Memecoins as a Growth Engine: Platforms like Pump.Fun have significantly increased network activity, boosting stablecoin inflows and reinforcing Solana’s role as the go-to blockchain for retail trading.

Scalability and Infrastructure Upgrades: Firedancer and Double Zero are set to redefine Solana’s scalability, with Firedancer increasing throughput beyond 1M TPS and Double Zero optimizing blockchain internet infrastructure to enhance speed and reliability.

2. Introduction

Over the last several months, Solana has emerged as a leader on key metrics such as aggregate protocol revenue, decentralized exchange (DEX) volume, and network fees paid.

These metrics provide data points on the greater story of Solana’s rebounding success in a post-FTX world. While there were key trade offs made in the design choices of Solana to optimize for performance, the strategic trade offs have led to a surge in activity and Real Economic Value (REV) being generated. Underneath this cascade of happenings, Jito, a protocol and network infrastructure provider, is helping the ecosystem flourish in a multitude of ways.

3. The Macro View: Solana’s Economic Health

For any blockchain’s Decentralized Finance (DeFi) economy, the pulse of the ecosystem is dependent upon the price and velocity of the underlying native network asset. For Solana’s SOL, the climb to its recent highs has been anything but easy. While SOL had previously reached a market capitalization of around $75bn in November of 2021 (~$250 a coin), it was beaten down terribly during the collapse of FTX, with which it had been closely aligned.

However, when all the dust began to settle, and people witnessed the resilience of select developer teams willing to “chew glass” and remain steadfast in their beliefs while they built through the chaos, SOL began to look attractive. Especially on a relative valuation basis to Ethereum’s ETH.

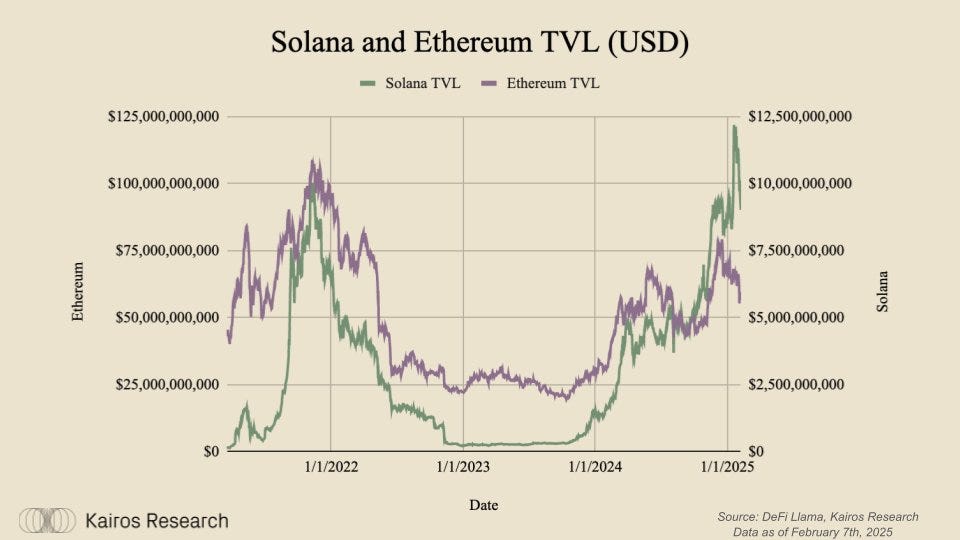

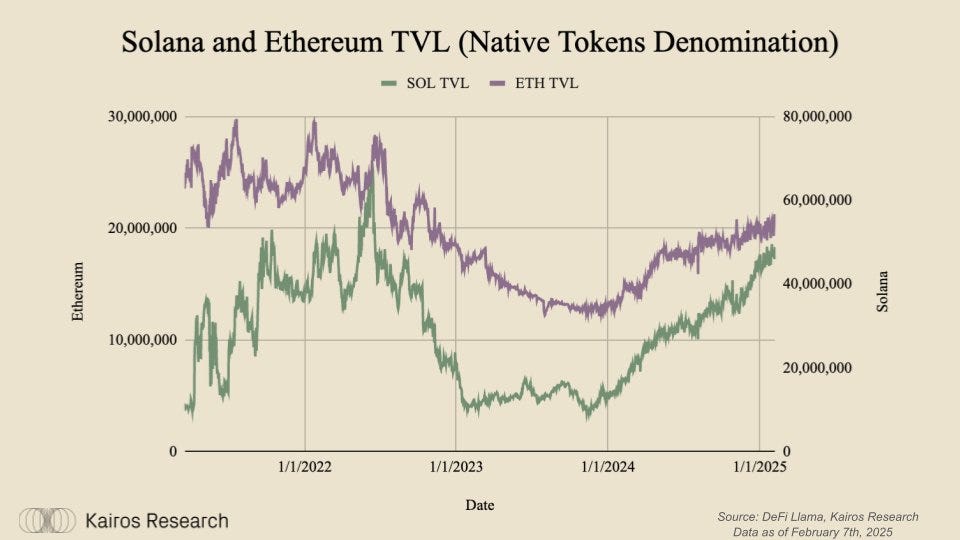

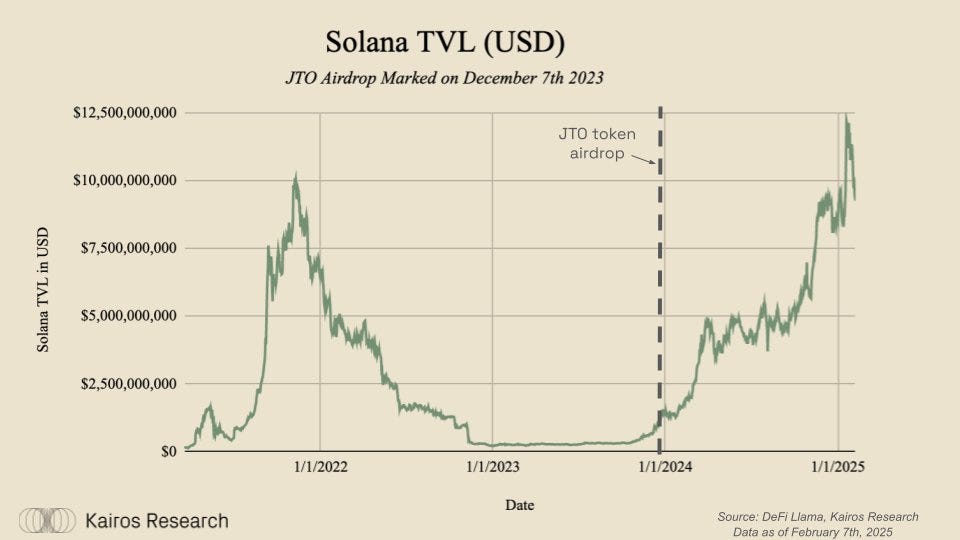

In crypto, price drives narrative, and narrative then drives price, creating a reflexive feedback loop. Therefore, SOL’s rebound started when it finally bottomed out at around $10 in December 2022. However, overall total value locked (TVL) remained in a downtrend on Solana, bottoming out in February 2023 - in SOL denominated terms around 10m SOL.

Solana’s TVL has been on a tear ever since, up to roughly 60m SOL at the time of writing. In dollar terms, the resurgence is even more astounding, surging from $230m to $14bn. The climb to $14bn (60m SOL) was not nearly as simple as the chart below makes it seem.

From December 2022 when things bottomed out for SOL, a few protocols saw massive rebounding growth: Save (fka Solend), Orca, Raydium, and Drift. From the bottom, their TVL has grown 2,390%, 658%, 9,580%, and 80,511% respectively. Non-coincidentally, all of these are DeFi protocols.

Also, when looking at Solana’s TVL chart, it’s hard to dismiss Jito’s $165M JTO airdrop playing a role in the economic resurgence of the chain. Solana’s power users receiving their airdrop stimulus coincided with BTC breaking old all time highs and breaching $70,000 - this combination appeared to be powerful enough to start the 2024 Solana snowball effect.

Since JTO was launched, several other key airdrops have taken place (Tensor, Parcl, MagicEden, Pyth, Pudgy & Jupiter). Notably, in January of ‘24, Jupiter, the chain’s leading DEX Aggregator and trading venue distributed 1 billion JUP (now valued over $1B) to Solana power users, with a promise to have several follow-on airdrops, one of which just took place.

Jupiter has written a post-mortem analysis on the first airdrop, showcasing how tens of millions of claim requests took place with a relatively low error rate and few network issues – one of the many stress-tests faced by the Solana network in 2024.

4. Deep Dive into DeFi on Solana

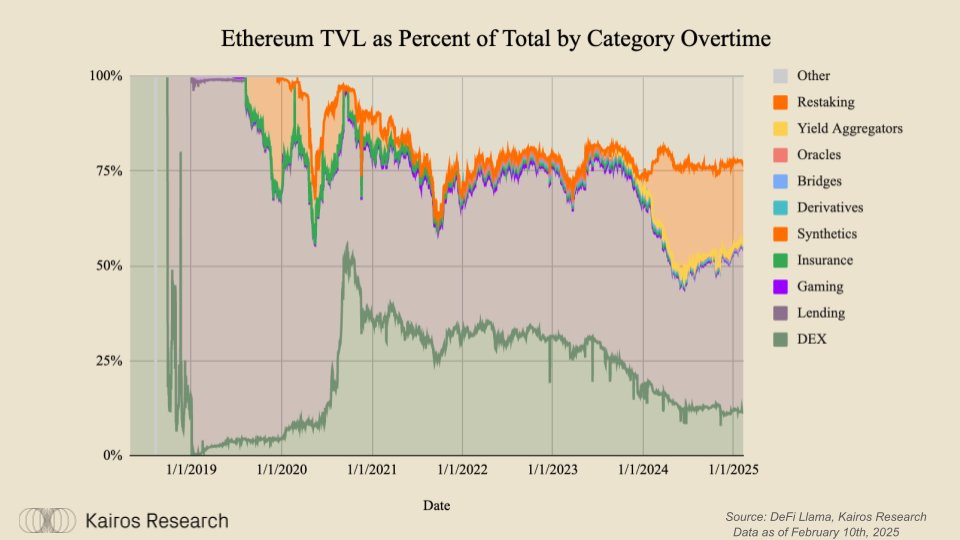

When looking back on Ethereum’s DeFi growth for comparison, much of it was catalyzed through protocols with concepts that were analogous to Traditional Finance (TradFi), but with different, improved mechanisms which allowed them to operate in the trustless environment of crypto.

The emergence of these primitive mechanisms coincided with a material increase in the price of ETH. This price increase was coupled with many protocols launching tokens of their own, which all led to a wealth effect across the ecosystem. However, as transaction throughput was still limited due to scaling constraints at the L1 level, a lot of the activity turned towards passive yield farming. This is an important bit of path dependency, as Ethereum’s DeFi activity all started with farming, that culture has stuck around. Solana’s DeFi activity will be looked back on as being catalyzed primarily with trading activity, not yield farming.

While yield farming on Ethereum was great in the short-medium term, it fostered an era of stagnation. However, with Solana, things unfolded much differently. Solana’s entire rise to prominence was catalyzed by an abundance of activity due to breakthrough primitives which could not have been built on Ethereum.

The wealth effect on Solana was first put into motion by the rise of SOL. This got more people using the network, and people started to use DeFi applications across the chain, specifically pre-token protocols such as Jito, Jupiter, Kamino, Marginfi, etc. The introduction of these protocols launching their tokens then led to an additional bump in the wealth effect of the network. Following these airdrops, users went out further along the risk curve and speculated on memecoins. While memecoin trading may not meet the world-changing purity test, this turned out to be more important than what first meets the eye.

The lower fees on a network like Solana make it a more attractive chain for a higher velocity of transactions, including payments and speculating on tiny, newly launched memecoins. Many of the same transaction types on Ethereum are more than 100x the gas cost, such that a fully different subset of users have formed on the respective chains. This low cost environment is exactly what led to Solana’s memecoin boom. At first thought, anyone can write off the idea of a memecoin being worth anything, let alone several billion dollars of market capitalization. However, this speculation led to a new primitive to emerge and find product market fit, in the form of Pump.Fun.

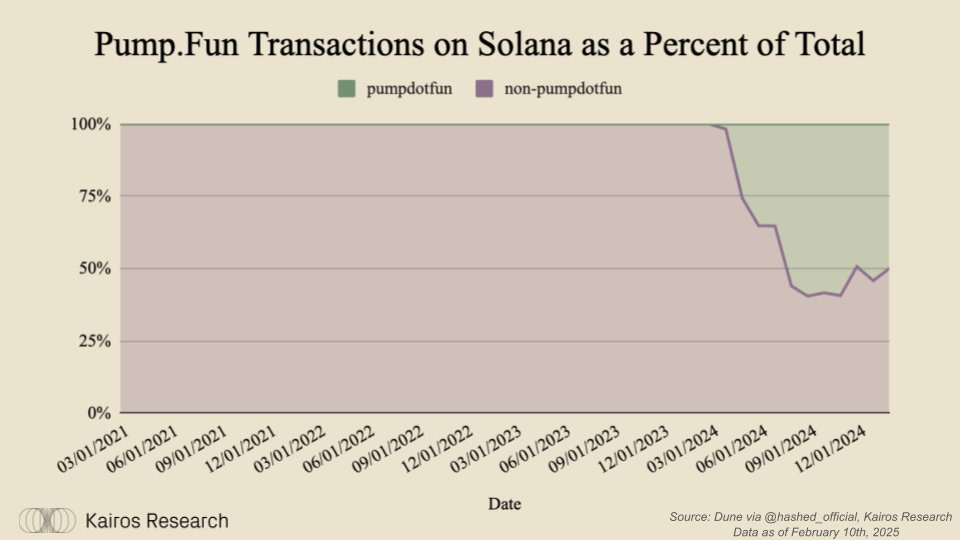

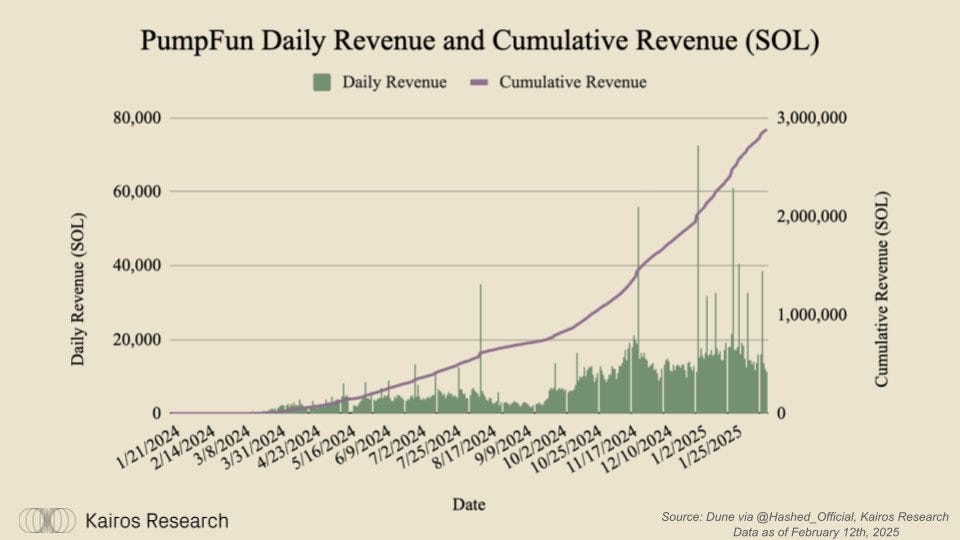

PumpFun allows users to easily launch tokens without technical expertise or liquidity. Say what you like about the platform itself, but there is no denying that this platform has had a positive impact on overall network activity and downstream benefits for various protocols. PumpFun started making waves in May of 2024, making up a significant portion of network wide transactions. In January, PumpFun accounted for 55% of all transactions on Solana. When a PumpFun token launches, prices dynamically adjust based on a bonding curve model that reflects supply and demand (i.e. SOL gets added to the bonding curve as users purchase the token).

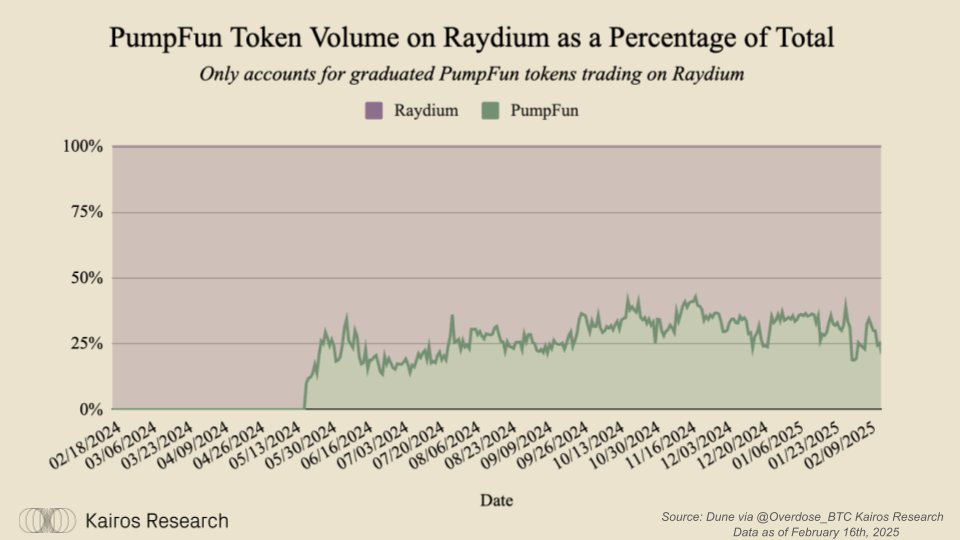

When a token “graduates” from the bonding curve, the remaining PumpFun token & SOL get transferred to “Raydium,” the leading DEX on Solana. As of February 16th, 2025, that has led to over $309bn of notional volume being traded on the platform for pump fun tokens that graduated.

This has led to a boost in the underlying fundamentals of Raydium, which has had roughly 25% of their median volume attributed to graduated PumpFun tokens. Given Raydium has fees on their swaps, this has driven millions of dollars of revenue to the protocol off of this activity alone.

This rebound in usage has also led to a rebound in token price, helping boost the wealth effect of long time holders, and also usher in a new era of fundamental driven buyers.

The influx of activity fostered by PumpFun participants onboarded many new users to the chain, and while its difficult to discern what percentage of their 13m total lifetime users are real from bots, one undeniable fact is that the protocol has made $553m in revenue from trading fees. This activity allowed distribution channels to emerge through various consumer platforms like Photon and Moonshot, along with wallets like Phantom and Backpack. The blending network effects of distribution and onchain liquidity has slowly but surely cemented Solana as the preferred go-to platform for new users.

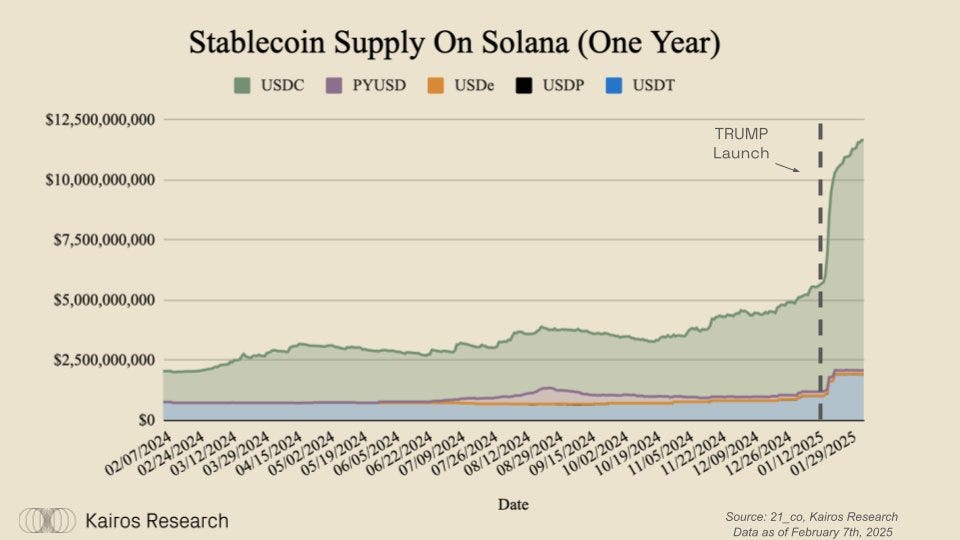

This was especially present for President Trump’s memecoin, which launched the weekend before his inauguration. The memecoin took an unusual route and launched with a USDC pair. This then led to an influx of USDC onchain, taking the Solana stablecoin supply to new all time highs north of $11bn, a colossal 86% increase in just two weeks. To put that into perspective, that’s roughly the entire market capitalization of Under Armour. While many things about these events were perplexing, one thing remained clear: platforms with the lowest fees, most users, and best distribution channels will continue to attract more onchain liquidity

5. MEV: Trends, Challenges, and Innovations

Up until March of this past year, Jito operated a mempool. While Solana’s architecture doesn’t include a native mempool, Jito Labs introduced this functionality to facilitate transaction ordering and enable validators to capture Maximum Extractable Value (MEV). However, in March 2024, Jito Labs suspended their mempool service due to concerns over “sandwich attacks”, a form of front-running where malicious actors exploit transaction sequencing to the detriment of regular users. According to blog posts from Jito Labs, this decision was made after discussions with key stakeholders in the Solana ecosystem to mitigate negative externalities impacting users.

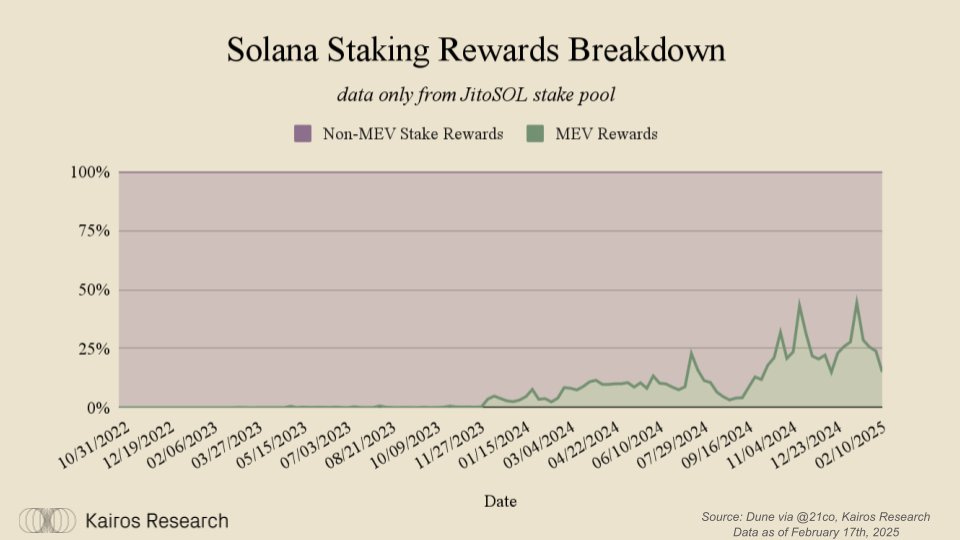

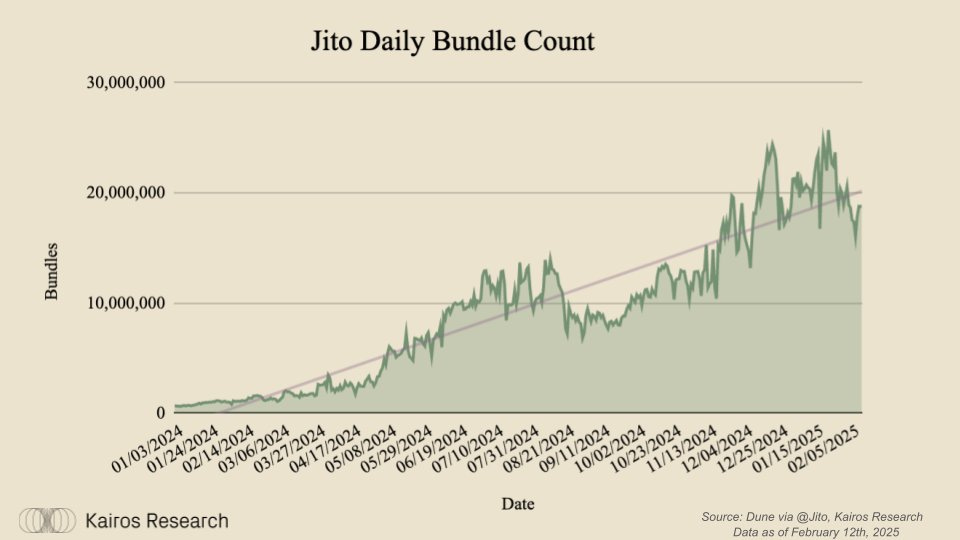

This was a mildly controversial issue amongst various community members at the time. However, today, tips and bundles are at levels higher than they’ve ever been before. Additionally, the removal of the mempool service by Jito allowed for better price execution for retail traders looking to participate with memecoin trading as the majority of sandwiching taking place on the network decreased drastically.

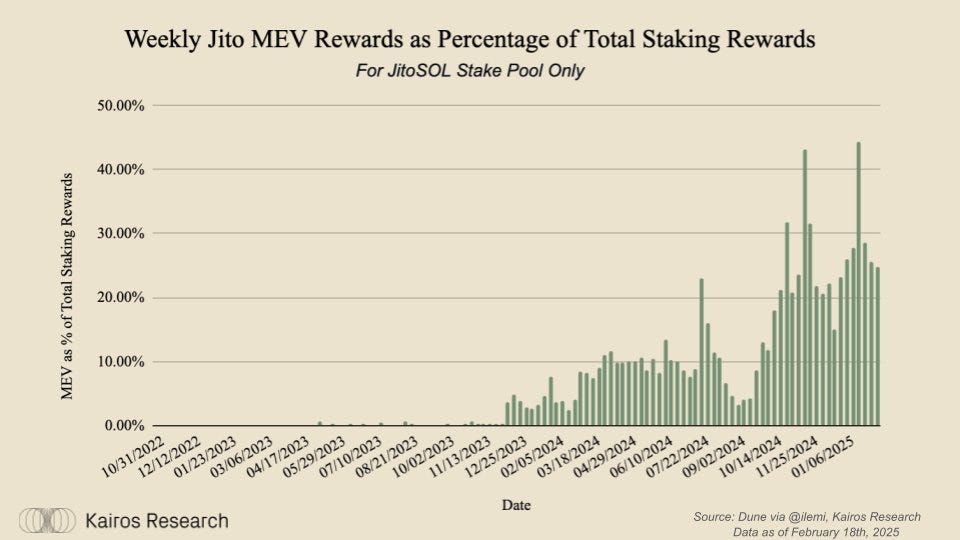

A rising tide has lifted all boats in this situation. As retail flow was able to receive improved execution through faster speed and less slippage, this had snowball effects. This allowed for a more egalitarian environment where the increased execution and ease from the user standpoint led to more trading, which led to more tips, which led to higher yields across the ecosystem for stakers.

Higher yields on SOL, specifically bolstered via MEV rewards, provided some attractive rewards that users wouldn’t be able to receive without staking. Overall, this cycle those rewards were, and continue to be, highly beneficial. The benefits of the activity is continuously felt around the ecosystem, with Jito’s newly launched TipRouter NCN which takes tips and distributes them through what would otherwise be a permissioned mechanism. Additionally, TipRouter can help plug some gaps left from SIMD-96, a Solana improvement proposal which redirects 100% of Solana’s priority fees to validators, eliminating the previous 50% burn. There is currently no easy way for validators to share priority fees with their stakers. While there is going to be some additional flexibility implemented here to service this issue with SIMD-0123, TipRouter allows for validators to share priority fees with stakers.

6. Token Economics: The Role of SOL

The core variable in Solana’s economy is the price of SOL. Earnings and revenue for blockchain networks have recently fallen into the limelight of debate and comparison. However, they shouldn’t be valued or compared to equities, and in our opinion L1 tokens function much more like a hybrid of a currency, an equity, and a commodity.

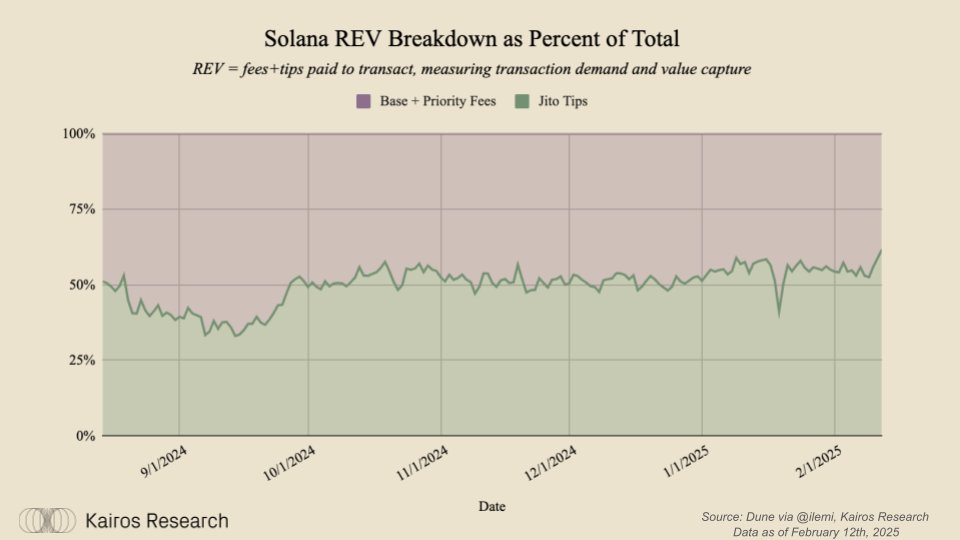

While the underlying demand drivers are up for debate, the market is the ultimate arbiter for the aggregate of all demand drivers. However, one helpful metric to understand the health of a blockchain network is Real Economic Value (REV) measured by fees + tips. This REV metric has important second and third order effects which are discussed more in depth in the validator section

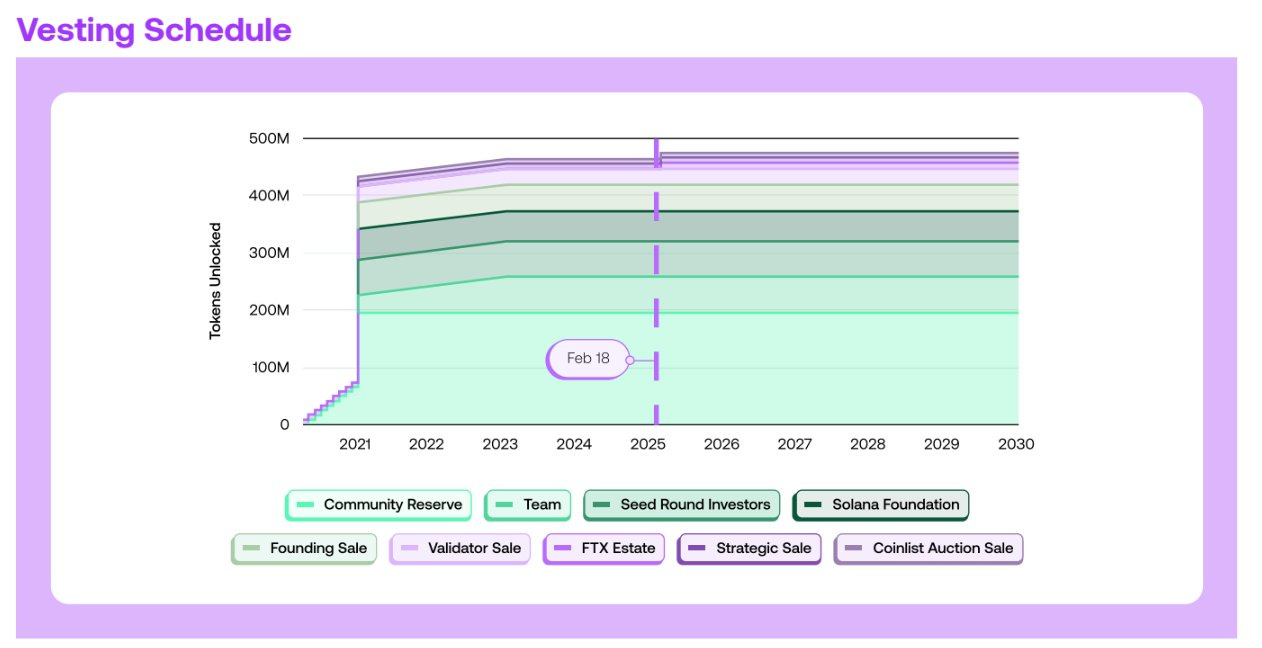

Supply One consistent topic that frequently arises within the Ethereum <> Solana debate is supply. While Ethereum launched via an ICO, Solana had a more traditional venture route, with several rounds of funding. This led to a token unlock schedule, as is common with most crypto projects. This, plus its overly simplistic inflation schedule has given Solana some unique structural differences that the market has had to stomach. However, at the time of writing, only 8.5% of the initial supply has not yet unlocked, and all of that is set to be emitted via inflation. The typical token unlock schedule for most crypto projects often come with criticism, and that is rightfully so. There’s no particular reason this should be the case, it’s just become the industry norm. And while this emission schedule for layer 1s can be particularly painful, it may have worked out for Solana in an unorthodox way that would be impossible to replicate. When FTX blew up, the estate then found themselves with a significant amount of the overall SOL supply, roughly 2.5% in total (11.8m SOL). This SOL was then “locked” and sold OTC in two tranches: one tranche around $64 per SOL and another tranche around $100 per SOL.

With a stake rate of roughly 62% at the time of the blow up and sales, the overall float of liquid tokens on the market was certainly impacted. And while difficult to discern how precisely this impacted overall market structure, it's certainly impossible to say it didn’t play a role. However, it’s also important to note that these FTX unlocks will have their own unique impact on the market given some buyers raised SPV just to purchase them.

Despite the road it took to get to where it is today, the SOL supply is unarguably mature. Having had 82.2% of the supply enter circulation according to Solana Compass, and the price having increased significantly from the lows, the issuance economics are now top of mind. On a daily basis, there’s roughly $41m of SOL emitted via block rewards. With a stake rate of roughly 65%, or $91.21bn, it's fair to argue there’s enough economic security. However, the flip side of that, is that current block rewards are continuing to enrich network participation, and that it's still very early in the chain’s history. While Ethereum has hotly debated the idea of minimum viable issuance, critics have proposed, maximum viable issuance, or the maximum optimal amount the network can emit to continue bootstrapping usage across the chain. However, as we alluded to above we are still in the very early stages of adoption, so a complete overhaul of the staking/inflation emission schedule could be risky if done wrong, but there is certainly room for improvement.

This is why Multicoin Capital recently introduced a market based approach to SOL inflation. The key stakeholders for this prop are stakers and validators, and validators have been becoming increasingly important on the Solana blockchain as the community aims to increase bandwidth and reduce latency.

7. Validator Ecosystem: Infrastructure and Economics

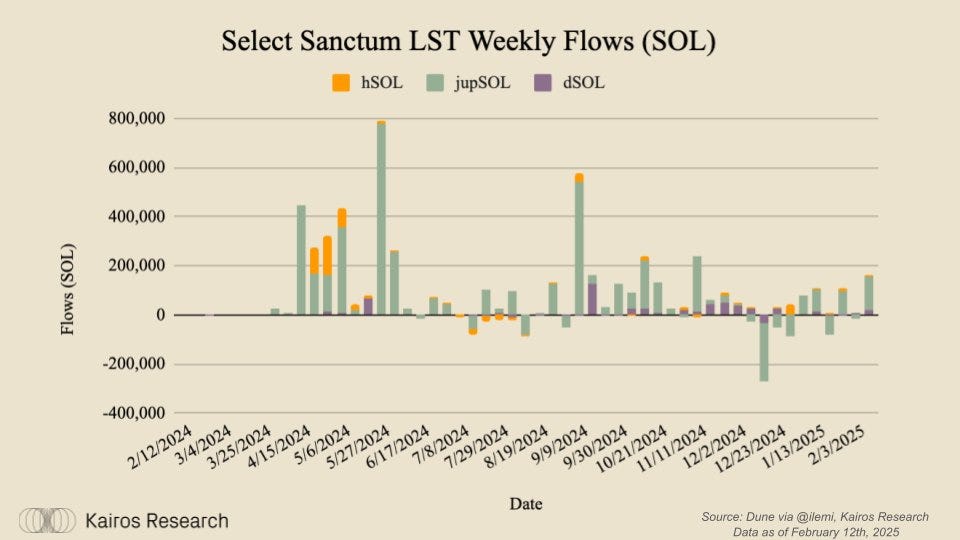

Validators have been key beneficiaries of the recent surge in activity for Solana. For example, in 2024 alone validators collectively made $612m. Additionally, in 2024 we saw a surge of protocols, exchanges, and various other entities launch their own LSTs. This was in large part due to stake weight quality of service (SWQoS) a feature in Solana that prioritizes transactions from validators based on their stake, and Sanctum. Sanctum is a liquid staking protocol on Solana that allows users to stake SOL and receive Liquid Staking Tokens (LSTs), which can be utilized in DeFi apps, while still earning staking reward.

Key Solana projects like Jupiter, Helius, Drift, and more have launched validator LSTs through Sanctum. For these three particular projects listed above, SWQoS also drove the decision. Between just those three projects, over 5m of SOL LSTs have been minted. This provides applications an opportunity to deepen their relationship with their users, and given Solana’s SWQoS, that means these application’s validators are able to produce more blocks, thus get more rewards back to stakers via block rewards, fostering a healthy flywheel.

8. Spotlight on Jito

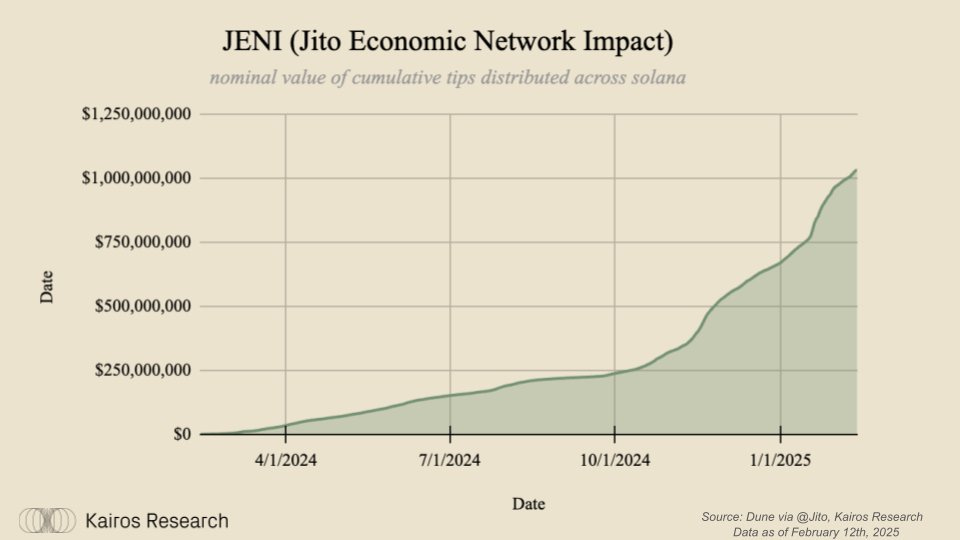

One theme which was undeniable throughout our research was Jito’s importance in the grand story of Solana. Jito has provided key infrastructure that not only helped optimize the performance of the network, but also helped return an abundance of value to the network as a whole. As of the time of writing, Jito has distributed over $1 billion in cumulative daily value of tips paid out to stakers and validators.

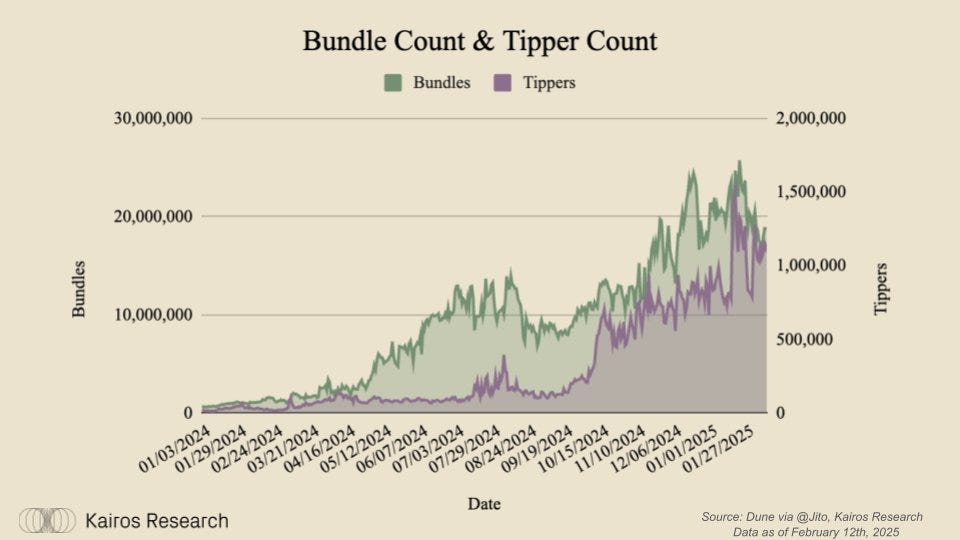

Jito’s bundles, or batched transactions which are sent to validators, have been up only for the last year.

During 119 out of the last 185 days, Jito has produced more fees than Solana itself, highlighting users' preferences for time sensitive transactions.

Jito also provides JitoSOL, the largest and most liquid LST on Solana. The LST is also unarguably the most decentralized amongst all its peers, thanks to Stakenet, a decentralized Solana stake pool manager. Stakenet provides Jito’s SOL in its stake pool to a curated set of validators based on their performance, staking yield commission, and overall efficiency, prioritizing those that maximize rewards while maintaining decentralization and network health. Thanks to the economics and incentives at play, Jito is able to attract a cohort of validators with zero commission on both staking rewards and MEV.

In tandem with their other contributions to the staking ecosystem on Solana, Jito has also recently launched Jito Restaking, a restaking platform that will host Node Consensus Networks (NCNs), similar to Actively Validated Services (AVS) on EigenLayer. NCNs are services that benefit from decentralized consensus.

One key example is Jito’s own NCN, TipRouter. TipRouter is an NCN responsible for distributing Jito validator tips, which is currently done via a permissioned mechanism. This provides an opportunity for additional real-yield to be passed on to restakers from the NCNs on the platform. Using the 90-day moving average for Jito Tips, TIpRouter is on track to distribute roughly $2.1bn of tips to validators and stakers on an annualized basis. This will account for $56m of tips going to the DAO treasury and $6.3m split 50/50 to JTO and JitoSOL restakers on a prorata basis.

9. Emerging Trends and Opportunities

While the success that Solana has seen has been well received by network stakeholders as a whole, it’s also important to note that many novel applications are thriving on the chain in the form of Decentralized Physical Infrastructure (DePin). Top projects like Helium, Hivemapper, and Render are all objectively successful projects in their own right. Helium created a decentralized wireless network where users deploy hotspots, earning HNT tokens for providing IoT connectivity. With nearly 1 million hotspots and coverage in over 77,000 cities across 192 countries, Helium leverages Solana's scalability to offer faster, cheaper transactions, focusing on expanding network coverage rather than managing the troubles that come with running their blockchain tech. Hivemapper is revolutionizing digital mapping by incentivizing users to contribute street-level imagery with dashcams, rewarding them with HONEY tokens. They've mapped over 25% of the world's roads, covering 140 million kilometers across 2,503 regions, aiming to provide fresher, more affordable maps than centralized giants like Google Maps, all while maintaining a decentralized and community-driven approach. Render on Solana has seen substantial engagement, processing over 19,000 rendering jobs per month, with a network of more than 1,900 node operators providing GPU resources, showcasing vibrant usage and the platform's capacity to handle complex computational tasks efficiently. Performance Optimization

On the performance side, Firedancer, developed by Jump Crypto, is set to redefine Solana's capacity, aiming for transaction throughput exceeding 1 million TPS. Its modular architecture promises upgrades without downtime, and its C-based client adds diversity to Solana's validator setup, enhancing resilience. The testnet success, coupled with Frankendancer's mainnet presence, heralds a new phase of stability and scalability for Solana.

Complementing this, DoubleZero tackles the internet's bottleneck for blockchains, constructing a dedicated rail for high-speed networks like Solana. This initiative not only aims to amplify Solana's performance but also to change how blockchain networks leverage internet infrastructure, ensuring they can operate at their full potential. Together, these developments illustrate Solana's dual focus on fostering breakthrough applications and pushing the boundaries of a network’s performance and connectivity.

SOL as a Reserve Asset

Beyond its immediate growth trajectory, SOL’s value proposition as a strategic reserve asset is further underscored by its robust infrastructure and adaptability to future demands. Solana’s ability to process transactions at unprecedented speeds, soon to exceed 1 million TPS with Firedancer, paired with its low-cost environment, positions it as a scalable foundation for both emerging decentralized applications and institutional adoption. As nation-states and corporations alike vie for dominance in the digital realm, SOL offers the US an opportunity to capture the upside in the accelerating shift toward blockchain-based economic systems. With its ecosystem already demonstrating why it has quickly become the leader, Solana stands as a forward-looking investment that could anchor the US as a powerhouse in the inevitable transition to a tokenized global economy. Recent price action also indicates that there is quite an appetite for SOL, having briefly eclipsed $300, putting it at approximately a $125bn valuation, still only a fifth of Visa’s market capitalization. This was also accomplished without any access to select cohorts of investors that are only possible through structure exchange traded products. While Bitcoin ETF investors are largely being sold a currency hedge narrative, Solana ETF investors will be able to take advantage of the fastest growing blockchain with real activity and rapidly growing fundamental driving its valuation higher. Put simply, SOL provides finest exposure to the inevitable shift of the global economy coming onchain.

10. Conclusion

Solana’s resurgence from the depths of the FTX collapse to flipping Ethereum on key metrics - DEX volume, network fees, and aggregate protocol revenue - is one of the most compelling comeback stories in crypto. From a $10 price bottom in December 2022 to a $14B TVL peak, the chain’s recovery has been fueled by a reflexive loop of price appreciation, on-chain activity, and new economic primitives. Jito has been at the center of this transformation, distributing over $1B in MEV tips, optimizing validator incentives, and ensuring network efficiency through its client software, now securing 90% of Solana’s stake.

Looking ahead, the challenge shifts from resurgence to sustainability. With the activity boom and continued validator optimizations on the horizon, Solana’s economic infrastructure is still positively evolving. Jito’s launch of TipRouter NCN and expansion into restaking signals that its role in Solana’s next growth phase is only getting started. Lastly, the data speaks for itself - Solana has cemented itself as crypto’s premier high-performance chain, and if recent trends hold, its dominance is only just beginning.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.