Jupiter Lend: An Emerging Pillar in Solana’s DeFi Superapp

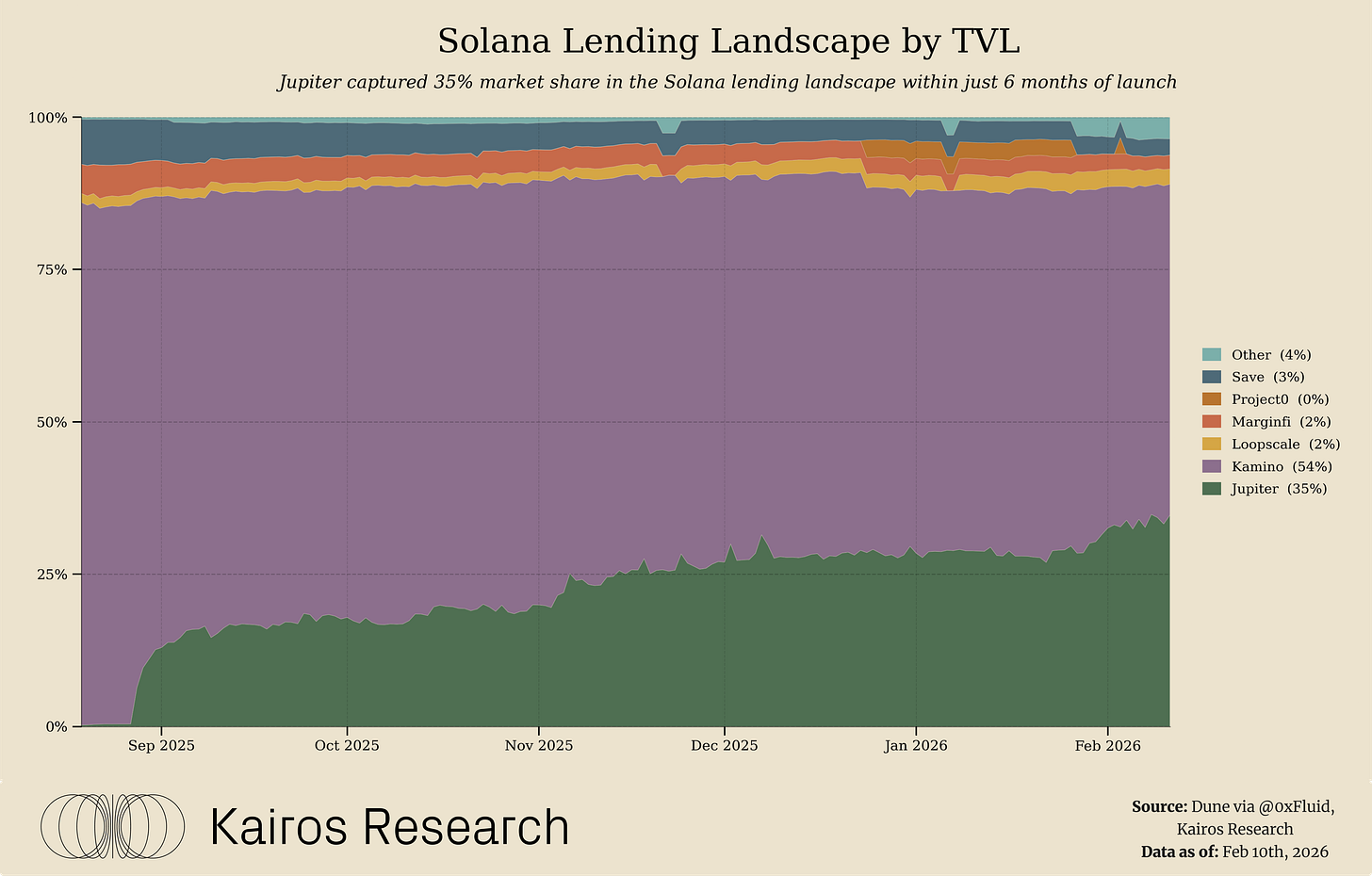

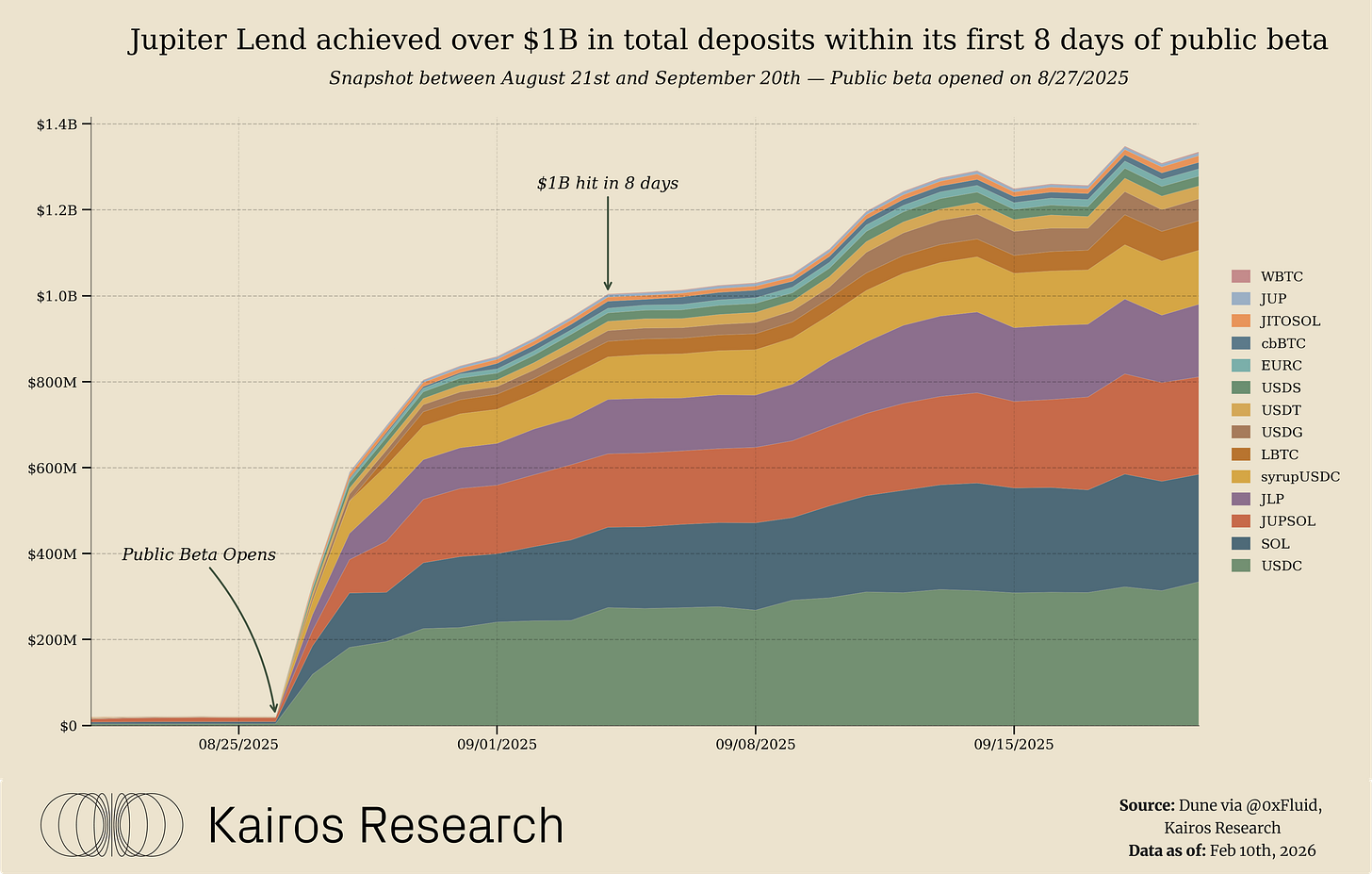

$1B in 8 days, 35% market share in 6 months, let’s dive inside the fastest lending launch in Solana’s history

Jupiter Lend in the Broader Jupiter Ecosystem

Jupiter Lend is the onchain lending arm of Jupiter, a Solana-based DeFi platform that has rapidly expanded from a simple DEX aggregator into a full-fledged “superapp.” Jupiter initially gained notoriety by routing swaps across Solana’s fragmented liquidity venues, capturing over 90% of Solana DEX aggregator volumes by December 2025. Over the past few years, the team leveraged this dominance to vertically expand, rolling out a suite of products from a perps DEX and token launchpad to a mobile app and portfolio tracker. However, lending was the missing piece. With Jupiter Lend which launched in August 2025, Jupiter can now keep users within its ecosystem for borrowing and lending needs, rather than ceding that activity to external protocols. In essence, Jupiter Lend transforms Jupiter into a vertically integrated DeFi platform, enhancing user stickiness and creating new revenue streams that flow back to JUP token holders. This strategic integration of lending could solidify Jupiter’s role as a one-stop DeFi hub on Solana, a critical step in its grand vision.

Thematic Drivers of Jupiter Lend’s Growth

Several thematic trends underpin Jupiter Lend’s early growth and differentiate its model within Solana’s lending sector:

Deep Composability & Integrations: Jupiter Lend isn’t a stand-alone money market; it is built in collaboration with Fluid’s liquidity engine to integrate more closely with Jupiter’s trading venues. Rather than leaving collateral and liquidity in individual markets, the design allows liquidity to be shared across the system, supporting more efficient use of capital within Jupiter’s ecosystem. This approach can improve utilization relative to fully isolated lending models and aligns with a broader shift toward more integrated DeFi products, where swapping, borrowing, and trading increasingly coexist within a single interface.

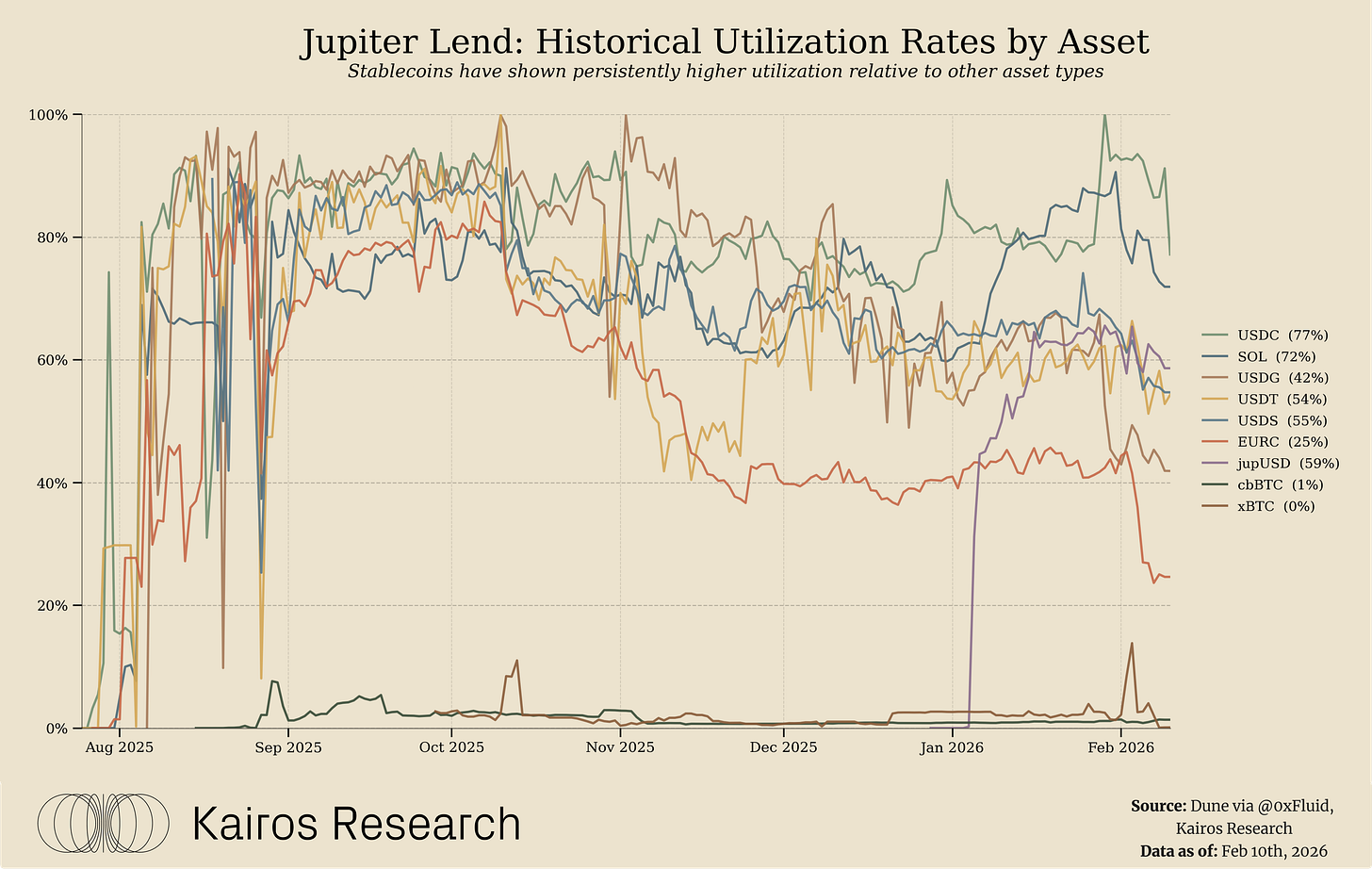

Optimal Capital Efficiency: Jupiter Lend’s integration with Fluid enables capital efficiency primarily through a shared liquidity and risk framework rather than higher leverage alone. Assets supplied via Jupiter Lend, including through vault-based products, ultimately route into the same underlying liquidity layer, allowing borrowing demand across products to draw from a unified pool of capital. This design improves utilization by reducing liquidity fragmentation and ensuring that deposits are accessible to borrowing demand across Jupiter’s ecosystem. Together, this architecture allows Jupiter Lend to deploy capital more efficiently without relying on complex collateral reuse mechanisms. It is also important that despite operating through several periods of market volatility, Fluid has not recorded any bad debt to date.

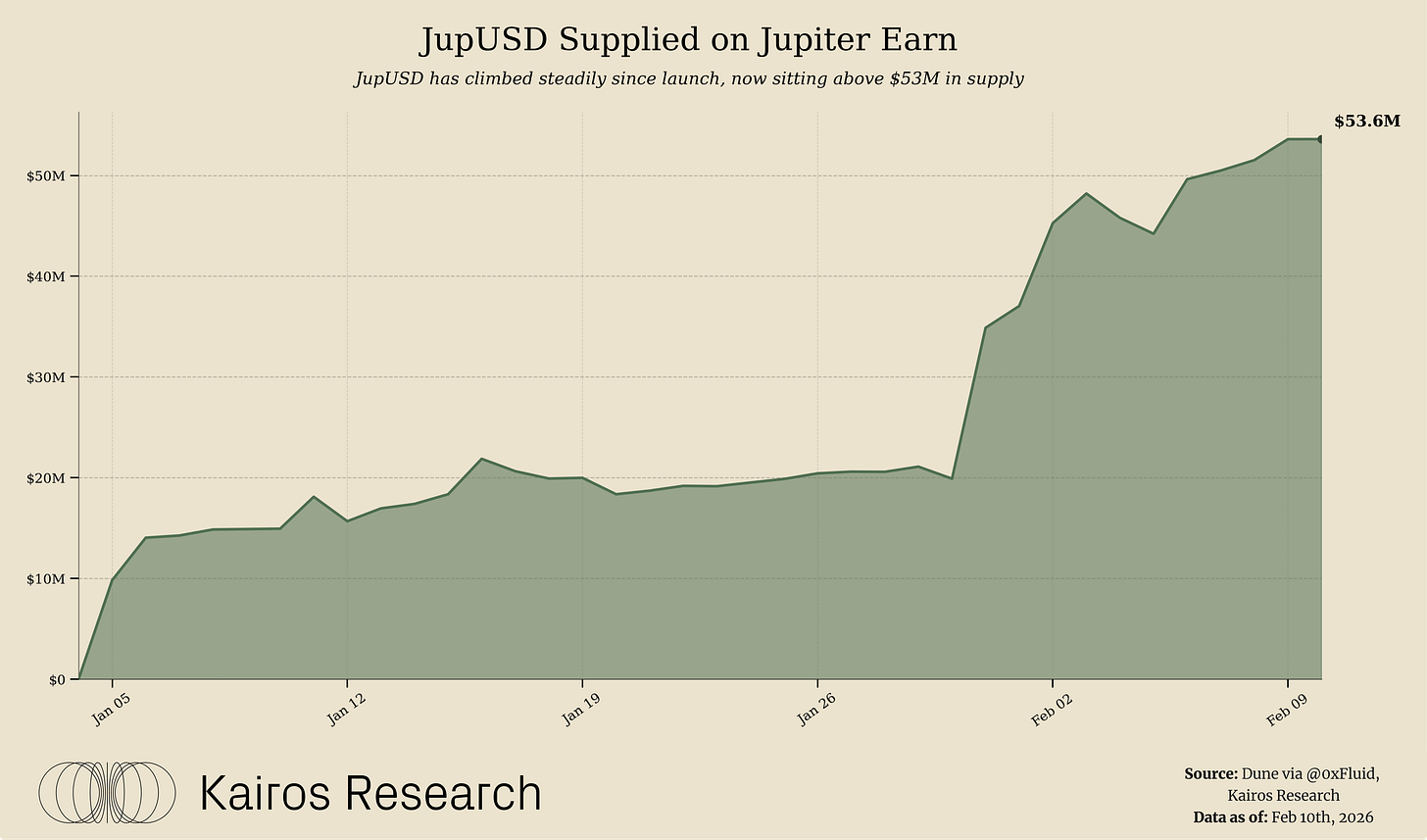

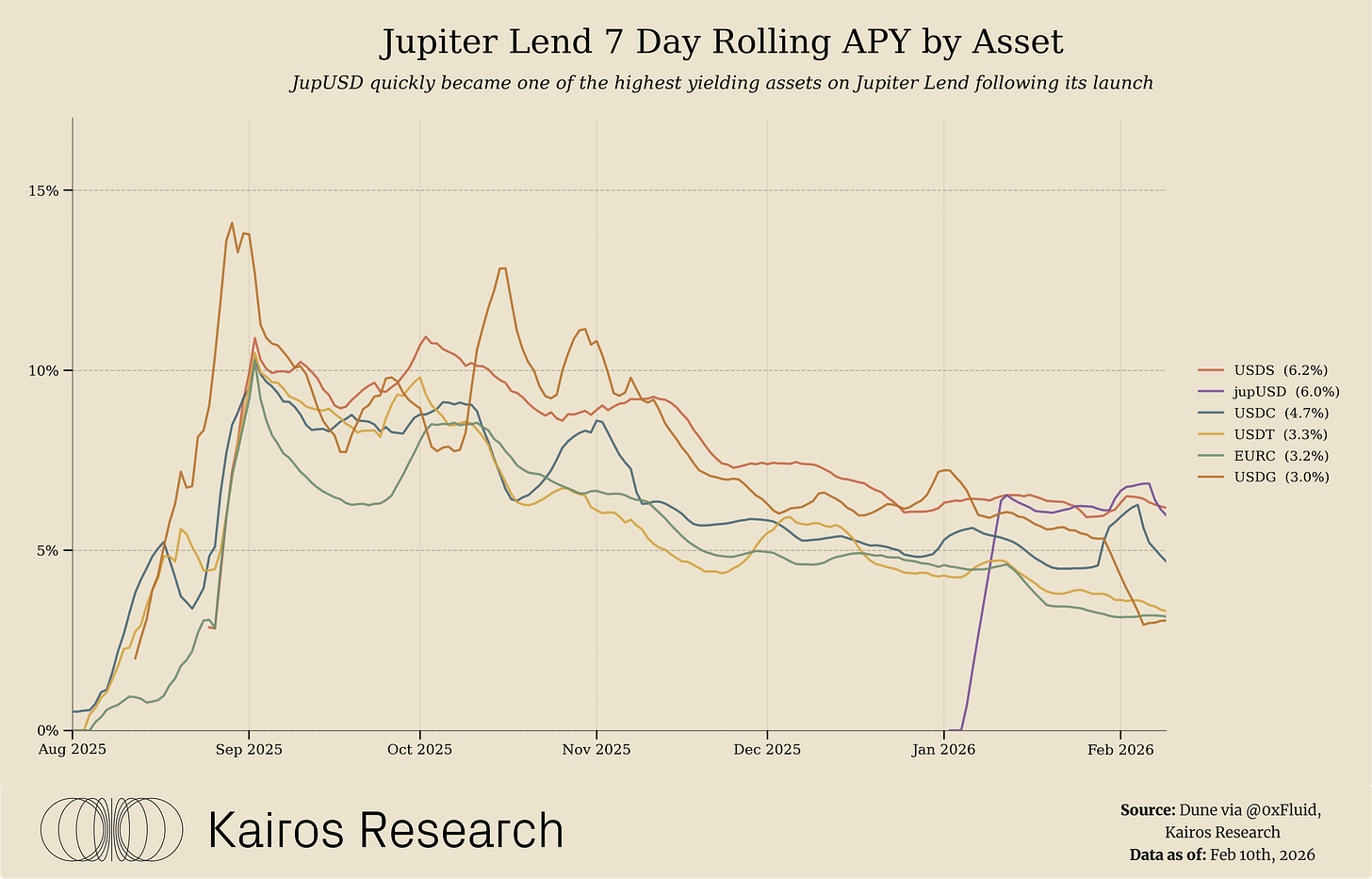

Stablecoin Synergy (JupUSD Strategy): Jupiter is following a growing DeFi trend, launching a native stablecoin, to anchor liquidity and revenue within its own ecosystem. In late 2025, Jupiter unveiled JupUSD, a Solana-native stablecoin developed with Ethena Labs. JupUSD is designed as a core liquidity and collateral asset across Jupiter’s products like perpetuals, lending, and swaps. It will initially be 100% backed by USDtb, which is essentially a wrapped version of BlackRock’s tokenized money market fund, BUIDL, with the later option of Ethena’s yield-bearing USDe. This effectively internalizes yield for JupUSD holders. The motive is clear: by issuing its own stablecoin, Jupiter can maintain value internally rather than outsourcing to USDC/USDT. This stablecoin strategy also strengthens Jupiter Lend’s appeal, as users will be able to borrow JupUSD against collateral at favorable terms, then deploy that stablecoin directly within Jupiter’s trading venues. It creates a self-reinforcing liquidity loop flywheel, where activity in one Jupiter product feeds others.

Early 2026 Growth Trajectory: Signs of Momentum

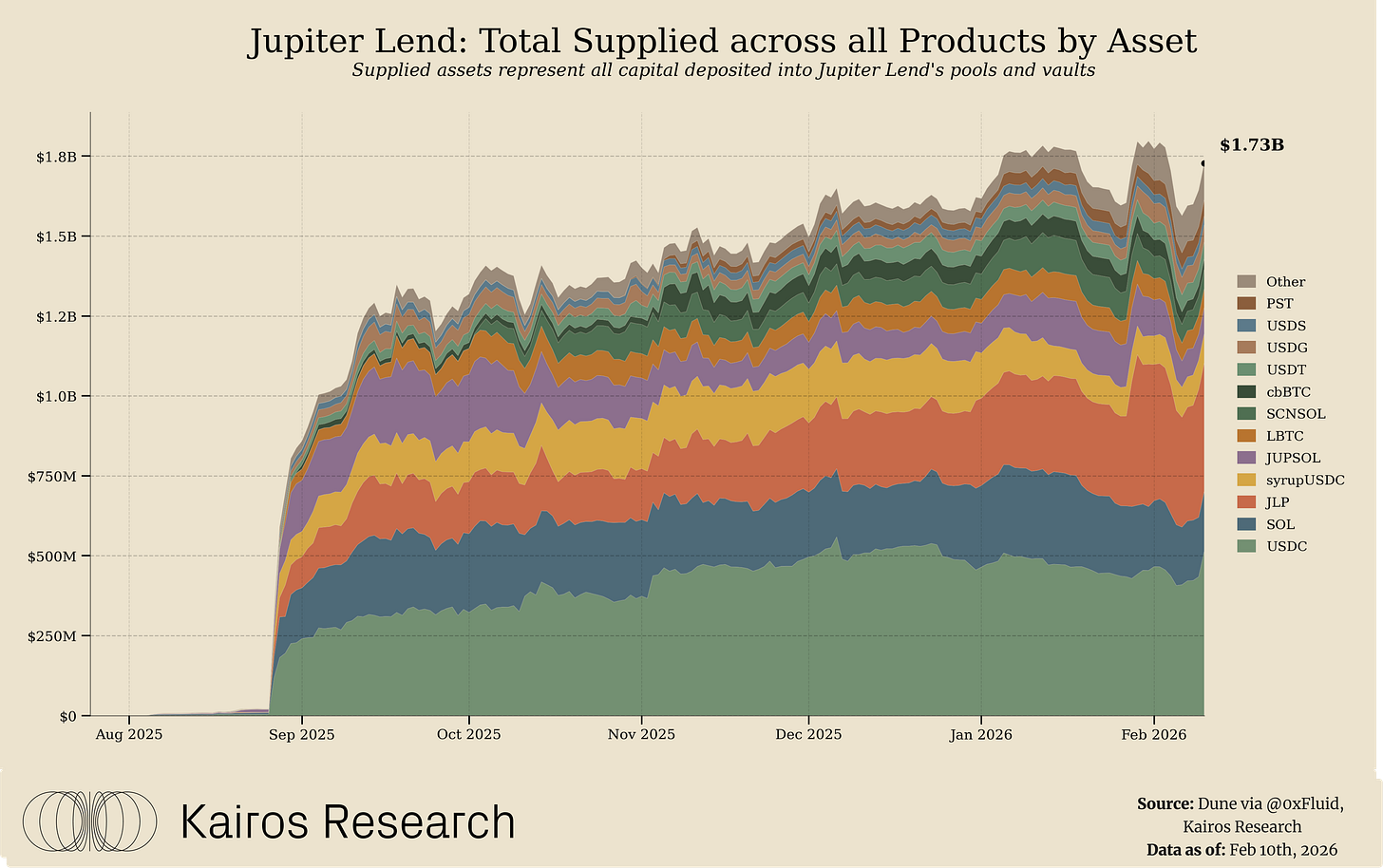

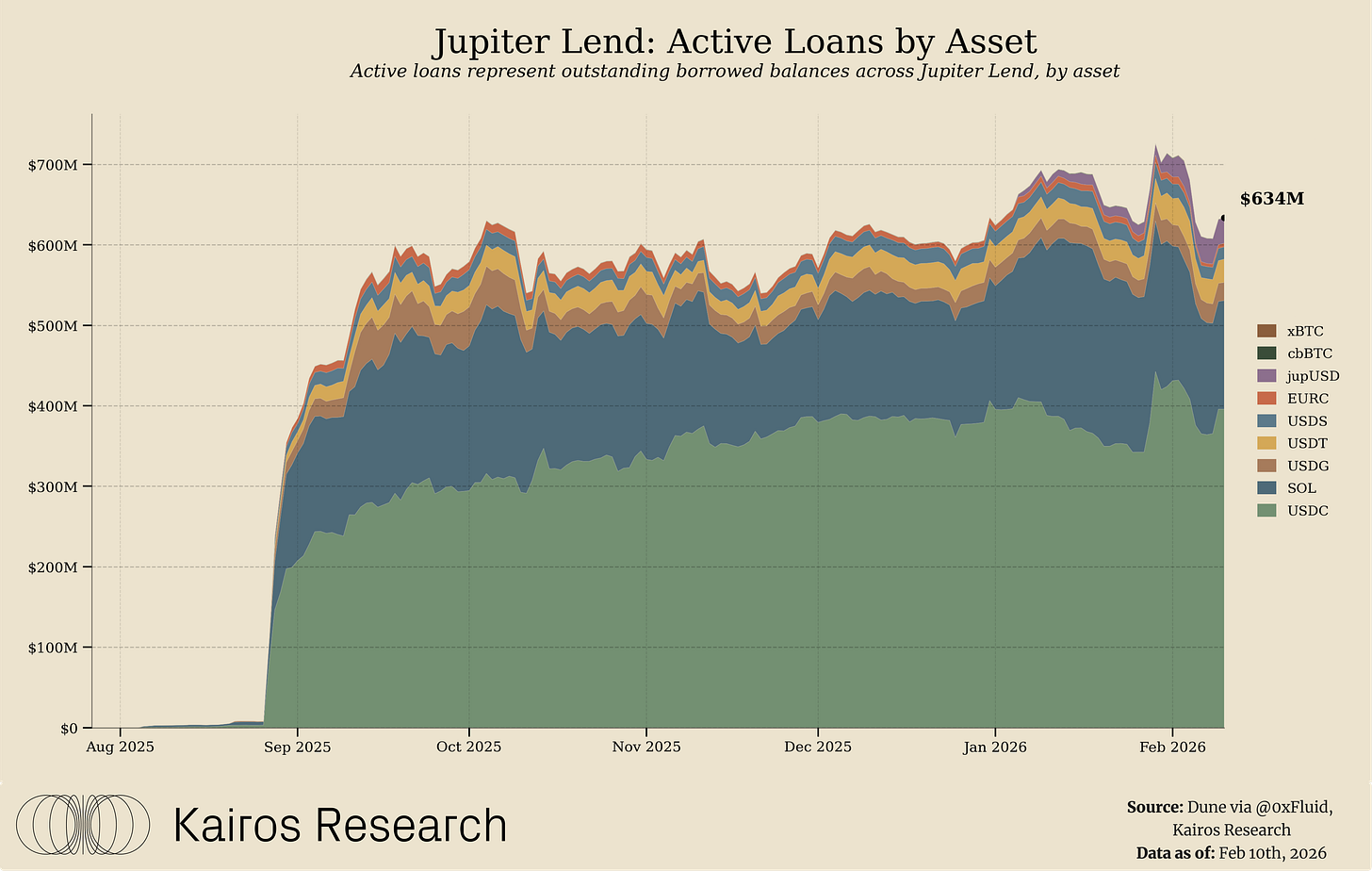

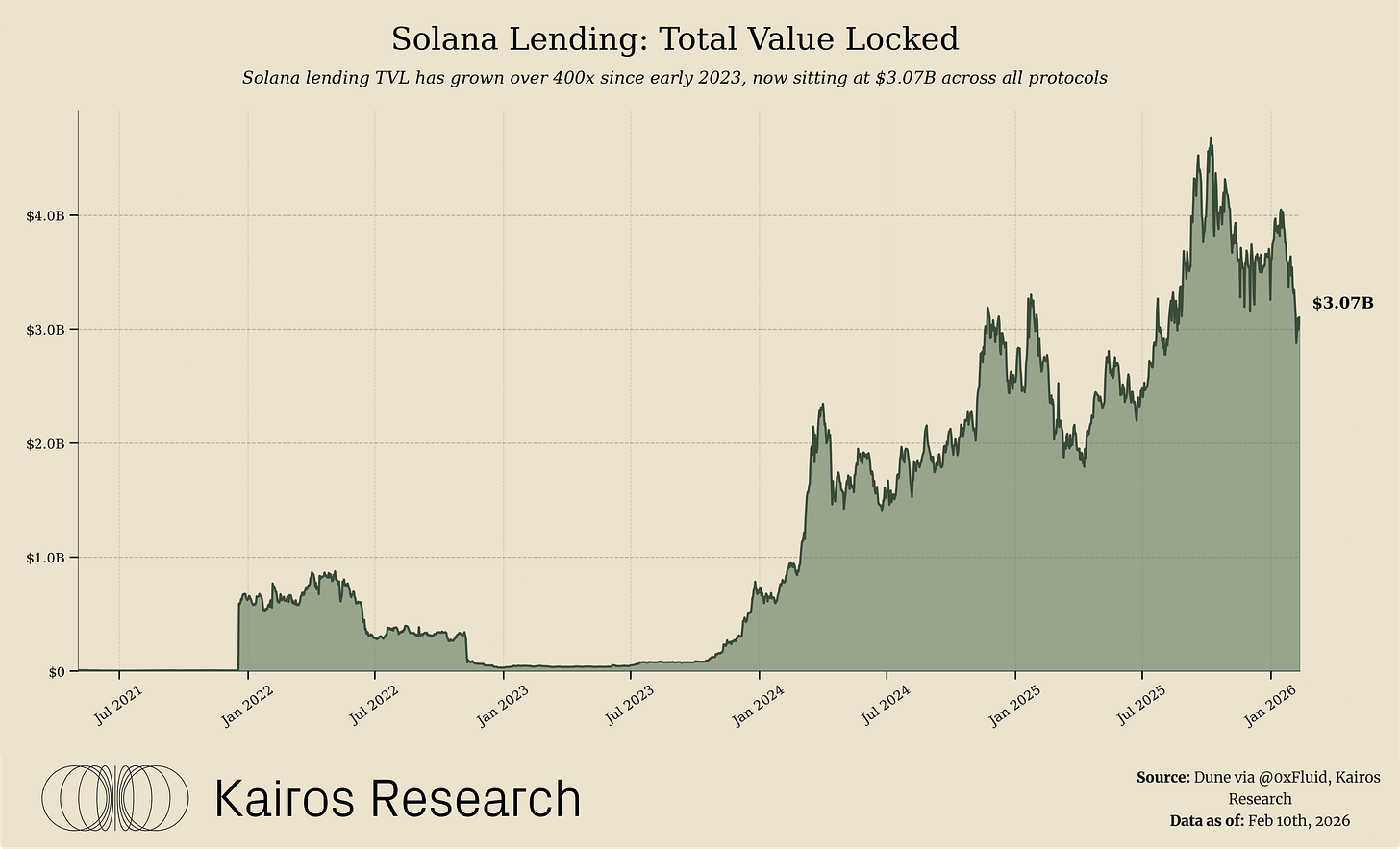

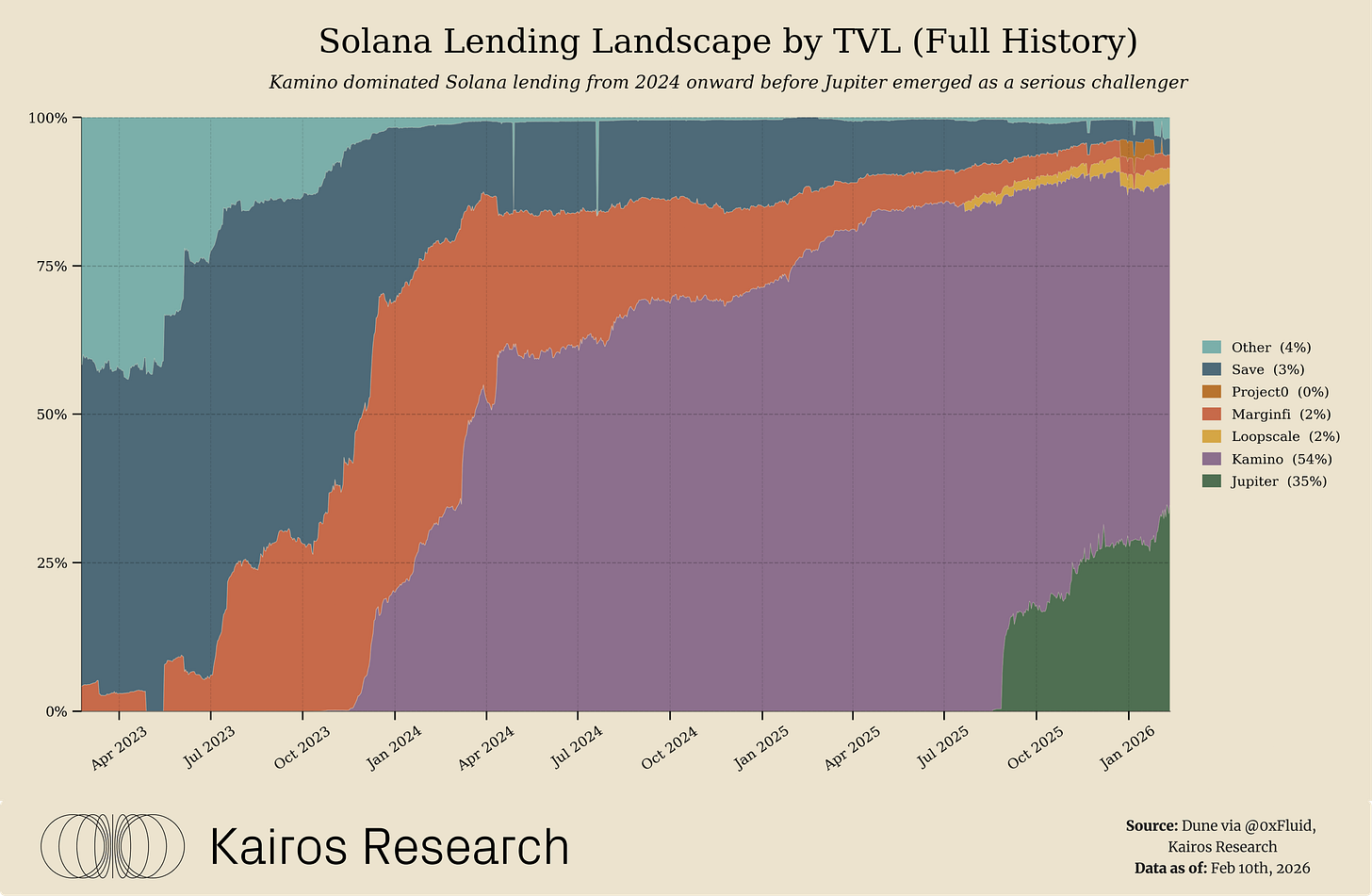

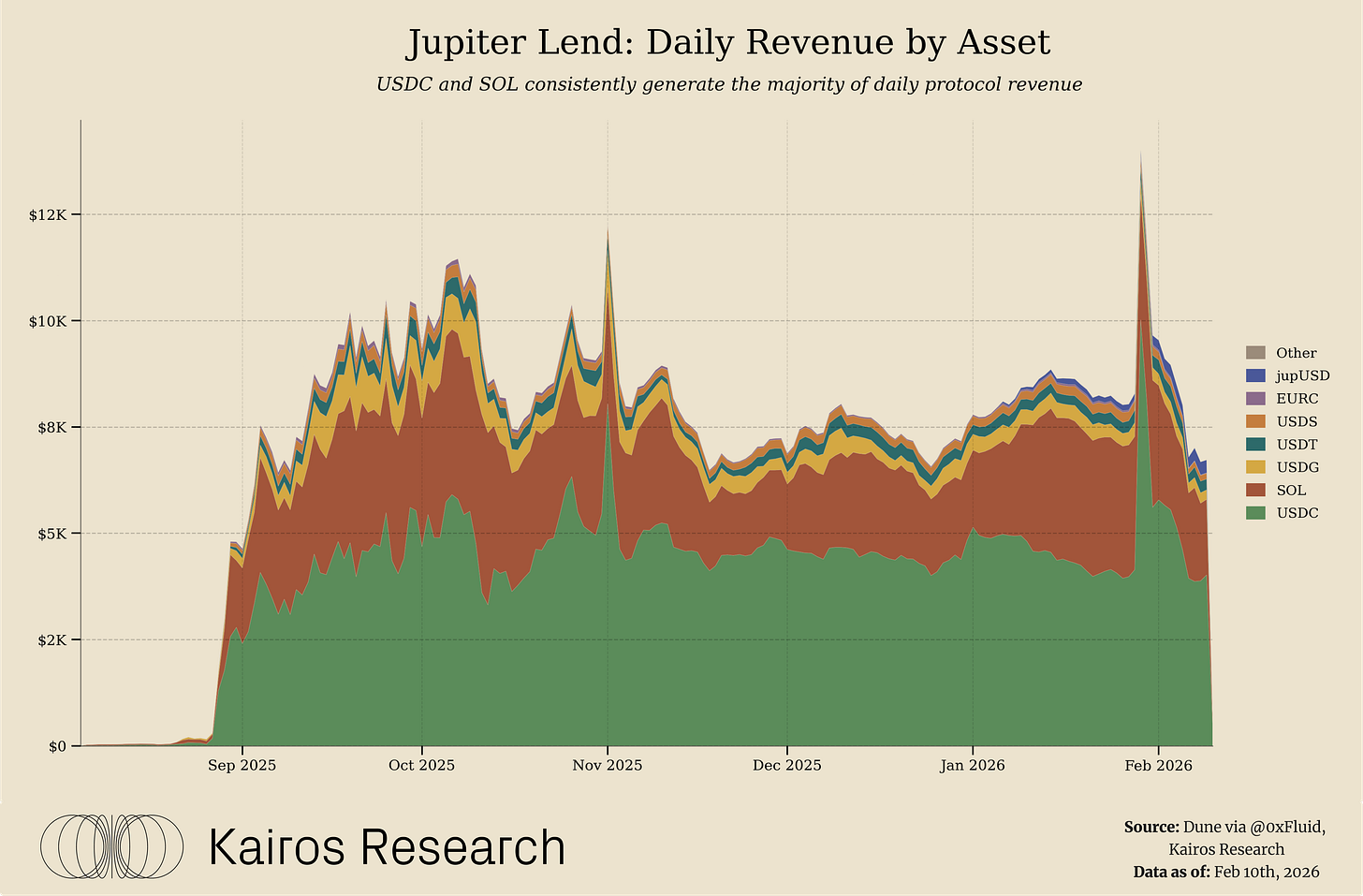

Jupiter Lend’s initial traction has been striking. In its first 8 days of public-beta, the protocol amassed over $1bn in deposits, a testament to Jupiter’s existing user base and brand trust. By early December 2025, Jupiter Lend’s TVL surpassed $1.5 billion for the first time, roughly 35% of Solana’s entire lending market. It now stands as the second-largest Solana lender, trailing only the long-dominant Kamino Finance. This growth from zero to $1bn+ in just 8 days underscores how quickly Jupiter leveraged its network effects to capture market share. Solana’s lending sector overall swelled to ~$4.6bn by late 2025, up 30%+ YoY, and Jupiter Lend has been a key contributor to that expansion.

Looking ahead into early 2026, Jupiter Lend’s trajectory appears upward, though the pace will depend on both market conditions and Jupiter’s execution of upcoming catalysts. If crypto markets remain constructive and Solana’s activity continues climbing, lending demand could grow further. Solana’s lending usage has mostly decoupled from price turbulence, driven by steady stablecoin inflows and new collateral types. In this context, Jupiter Lend is well-positioned to keep gaining share. It offers one of the most feature-rich and integrated borrowing experiences, which could attract additional liquidity from users seeking higher yield or better UX than rivals. It’s plausible that by Q2 - Q3 2026, Jupiter Lend could challenge Kamino more directly; Kamino’s deposits have actually been declining from ~$3.37bn in October to ~$1.67bn by early Feburary amid competition. Jupiter Lend could approach the #1 spot if its momentum persists, especially as new features like JupUSD prove fruitful. In absolute terms, crossing $2 billion TVL in the coming months is not out of the question if Solana’s DeFi lending sector continues its growth trend and Jupiter successfully onboards more collateral and users.

Catalysts on the Horizon for Jupiter Lend

Several upcoming developments could significantly influence Jupiter Lend’s growth and adoption in early 2026:

JupUSD Implementation Across the Stack: The full launch and integration of Jupiter’s native stablecoin is a major catalyst. With JupUSD live as of January 5th, 2026, Jupiter Lend has begun accepting JupUSD as collateral and offering JupUSD borrowing. This has multiple benefits:

1. It anchors liquidity: users borrowing JupUSD are likely to keep funds cycling within Jupiter’s ecosystem, increasing total platform TVL.

2. It can improve fee capture: JupUSD generates internal yield via Ethena’s model and saves users from relying on external stables, which means interest paid on JupUSD loans largely goes back to Jupiter/its users.

3. It bolsters composability: for instance, a trader could borrow JupUSD on Jupiter Lend and immediately deploy it on Jupiter’s perps exchange or the swap router without leaving the app.

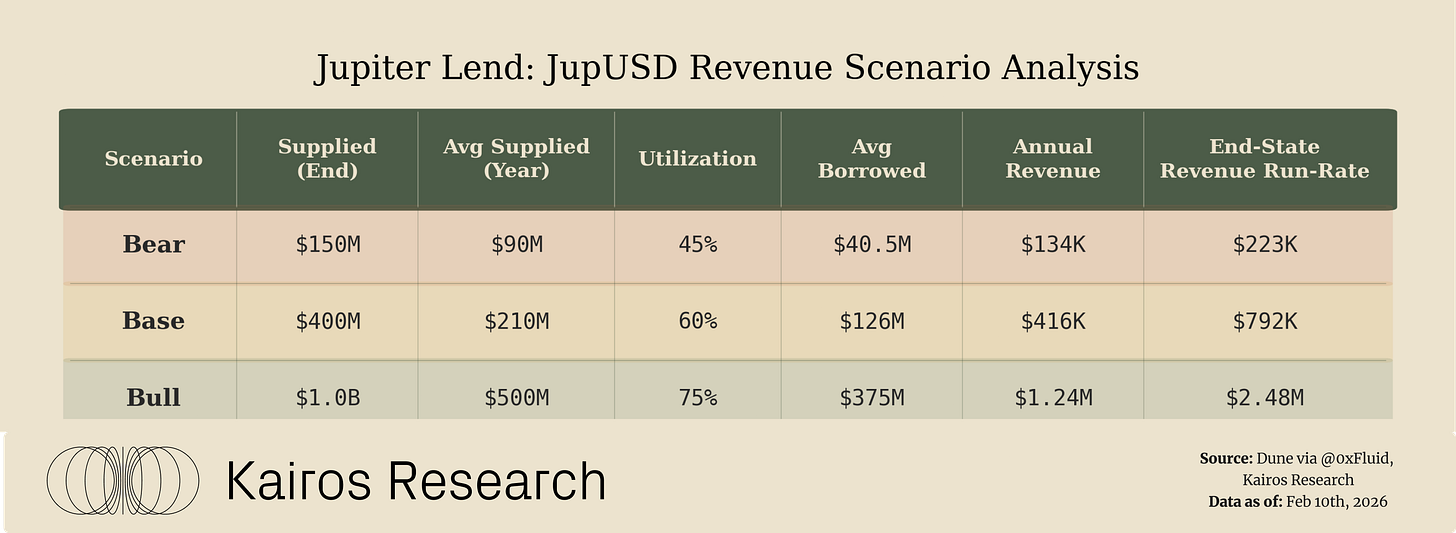

Looking ahead, JupUSD also introduces a new, scalable revenue vector for Jupiter Lend.

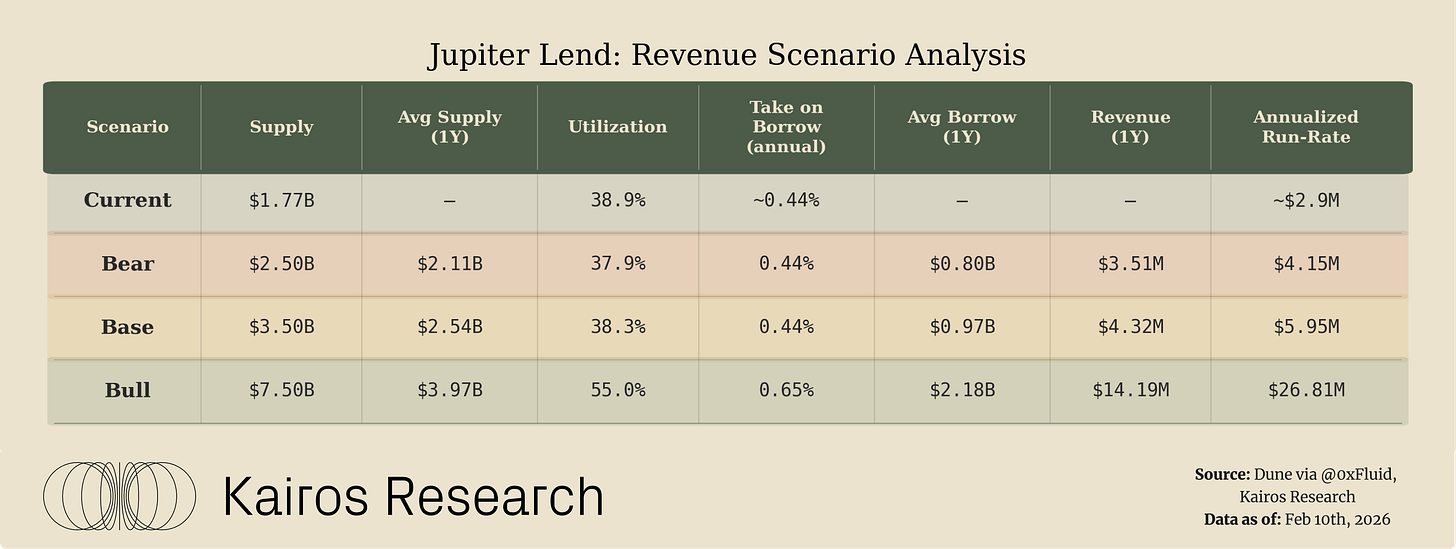

Our one year projections evaluate JupUSD across bear, base, and bull scenarios by varying two core inputs: total supplied JupUSD and utilization. Even under conservative assumptions, JupUSD begins to contribute incremental revenue as supply grows. In the bull case, where JupUSD reaches $1bn in supply and utilization converges toward levels observed in established stablecoins like USDC, JupUSD alone supports a multi million dollar annualized revenue run rate. While not intended to be a standalone profit engine, JupUSD materially strengthens Jupiter Lend’s unit economics and reinforces a self reinforcing liquidity flywheel across lending, swaps, and perps.

New Collateral Support via RainFi (Jupiter Orderbook): Jupiter isn’t stopping at mainstream assets, it recently acquired RainFi, a lending tech platform, to launch “Jupiter Orderbook,” a peer-to-peer lending product in Q1 2026. This expansion will enable lending against more long-tail and off-chain assets that aren’t suited for pooled lending markets. In other words, Jupiter could support collateral like tokenized stocks, longertail altcoins, or other bespoke assets by matching lenders and borrowers directly, orderbook style, rather than relying on a shared liquidity pool. Kamino has already moved in this direction, as it was first to accept tokenized equities as collateral, Jupiter clearly wants to one-up competitors by offering a broader menu of collateral options. If executed well, this can attract niche lending demand and institutional players who want to borrow against non-traditional assets on Solana. The RainFi-powered product also suggests Jupiter is addressing the limitations of its Fluid-based model, which currently focuses on a set of whitelisted vault assets, by adding a flexible P2P layer. New collateral support, combined with Jupiter’s large user base, could significantly boost Jupiter Lend’s market share and increase the total addressable market of borrowers in early 2026.

Cross-Margin and Unified Accounts: A likely next step for Jupiter’s “superapp” will be offering cross-margining across its various trading and lending products. Today, users have separate collateral pools for different activities such as isolated perps margin, lending collateral, etc, but Jupiter has hinted at unifying these. The Fluid engine already blurs lines between DEX liquidity and lending, and it’s plausible Jupiter will extend this to unify spot, perps, and lending positions under one margin account. Such cross-margin features would let a user leverage their entire portfolio on Jupiter, essentially using LP tokens or even borrowed assets as margin for trades, boosting capital efficiency one step further. While not officially launched yet, we know Jupiter opened its Lend codebase and launched a developer platform in late 2025, which often precedes sophisticated features like cross-margin. If cross-margin goes live in 2026, it will be a major attraction for advanced traders, essentially positioning Jupiter Lend, and Jupiter exchange, as a decentralized equivalent of a prime brokerage account. This could drive volume and borrowing demand, as users consolidate activity on Jupiter for convenience and efficiency.

Incentive Programs and Rewards: Jupiter has been unafraid to use incentives to bootstrap growth. A $1 million rewards program accompanied Jupiter Lend’s beta launch, and another $1M in rewards was announced for Jupiter’s ecosystem in late 2025 via the “Jupiter Rewards Hub”. Additionally, January 2026 will feature the final “Jupuary” airdrop of JUP tokens to active users, including lenders/borrowers. While one-time airdrops can lead to post-event pullbacks, Jupiter’s broader incentive strategy of ongoing JUP buybacks funded by fees will continue to play a role. Catalysts on this front include new potential liquidity mining campaigns for JupUSD adoption or for specific vaults if Jupiter wants to accelerate growth in certain assets.

In the near term, incentive-driven surges can boost metrics like TVL, active users, etc, but the more important thing to watch is whether Jupiter can retain those users once rewards taper. A well-designed program could convert mercenary capital into loyal users if coupled with Jupiter’s strong product offering.

Key Structural Risks and Constraints

Despite its rapid ascent, Jupiter Lend like any protocol has risks that should be considered:

Cross-Vault Rehypothecation Risk: Jupiter Lend is built on Fluid’s unified liquidity architecture, meaning deposits and borrowing activity across Jupiter Lend products source liquidity from the same underlying pool rather than fully isolated vaults. In practice, this functions as a constrained form of rehypothecation, where liquidity supplied to one vault can support borrowing in its paired vault, improving utilization by reducing fragmentation. However, this reuse is not unlimited: it is bounded by how vaults are constructed (i.e. through specific asset “pairs” via vaults), conservative risk parameters, and strict asset listing standards that prioritize high-quality, liquid collateral.

The primary risk is therefore less about hidden leverage and more about complexity and user expectation management. A shared liquidity layer is less intuitive than siloed pools, and users may assume “vault isolation” that does not exist. Jupiter and Fluid mitigate this through conservative collateral selection, dynamic risk limits, and a liquidation system designed to unwind risk via swap-based, incremental liquidations, helping contain stress even when liquidity is shared across products.Reliance on Incentives and Yield Sustainability: Much of Jupiter Lend’s early growth has been fueled by above-market yields, sweetened by token incentives and aggressive parameter tuning. While effective for bootstrapping, this strategy can be a double-edged sword. Continuously paying high APYs, either via token rewards or foregoing protocol fees to boost lender rates, is not sustainable indefinitely. It’s important to note the platform has never done the latter. Already, we see Jupiter is splitting interest revenues with Fluid and taking only a portion as platform income, which may limit its ability to keep subsidizing rates long-term. However, given both teams split revenue and incentives, this provides mutual skin in the game, providing an equal incentive structure for both teams. If market conditions shift, say borrowing demand falls or a competitor like Kamino ramps up their rates, Jupiter Lend may need to dial back yields. A potential stress point is when the initial reward programs conclude: will liquidity stick around for the product’s merits, or chase the next incentive elsewhere? Jupiter will need to carefully transition from incentive-led growth to organic growth. The encouraging sign is that Jupiter Lend generates real revenue, with over $10M cumulative interest paid by borrowers as of year-end 2025, so the platform could taper rewards if it maintains competitive features and UX. Still, investors should monitor yield levels on Jupiter Lend; a steep drop in APY could lead to outflows if not managed, and conversely, maintaining unsustainably high APYs could strain the system.

Competitive and Market Share Pressures: Jupiter Lend has stepped into a highly competitive arena. Kamino Finance, the incumbent, still controls about 54% of Solana’s lending TVL and has shown it will fight to defend its lead, but its also important to note Kamino’s market share was even higher previous to Jupiter entering the arena. The recent saga where Kamino censoredJupiter’s refinance tool which prevented easy loan transfers is a case in point. Such tactics indicate that rival platforms may not play nice. Beyond Kamino, smaller players like MarginFi, Maple, Loopscale and others are also vying for niches. Jupiter must continue innovating to avoid a plateau in user growth once the initial novelty wears off. There’s also the threat that competitors will copy Jupiter’s features: for example, if Kamino, or another Solana protocol, partners to offer a similar stablecoin or fluid-like integration, Jupiter’s edge could narrow. However, forking code is of course not equivalent to forking TVL. Market share defense may require Jupiter to spend on continued incentives or pursue more acquisitions, similar to how it bought RainFi. Moreover, as Jupiter expands cross-chain via JupNet in the future, it may find new competition on other chains. In short, maintaining its growth “moat” will be an ongoing challenge. Jupiter’s multi-pronged approach as an aggregator + perps + lend + stablecoin is ambitious, but also means it’s competing on many fronts at once. The positive is Jupiter’s strong brand and user base on Solana, which give it a network-effect advantage if it keeps users satisfied under one roof.

Operational and Structural Complexity: As Jupiter evolves into an all-in-one DeFi platform, the complexity of its system grows. Integrating many services such as spot, perps, lending, stablecoin, P2P loans, etc, introduces operational risks, from smart contract bugs to liquidity fragmentation if not managed properly. Jupiter Lend’s dependency on Fluid’s smart contracts means any issue on Fluid’s side, whether on Solana or even Ethereum, where Fluid originates, could spill over. The partnership splits fees 50/50 between Jupiter and Fluid, which is great for collaboration but could create incentive misalignment or coordination challenges in emergencies. Additionally, rapid growth often attracts regulatory attention. A platform offering high-leverage lending and its own stablecoin will certainly be on the radar if any user losses or failures occur. Jupiter’s decision to pause its DAO governance until 2026 due to concerns over team voting power also raises questions about centralization and how decisions are made in critical moments. While these issues haven’t manifested in a crisis yet, they form the backdrop of risk that should be kept in mind. Jupiter is attempting to build a financial behemoth on Solana, but that means it must execute flawlessly across multiple complex products, which is a high bar to meet.

Jupiter’s DeFi Stack and the Solana Superapp Thesis

Jupiter’s endgame is to be Solana’s DeFi superapp, and Jupiter Lend is a cornerstone of that strategy. By offering lending alongside trading, staking, and stablecoin minting, Jupiter is crafting an ecosystem where users can do virtually everything financially in a single, cohesive application. This aligns with a broader industry thesis: the next wave of crypto adoption may be driven by platforms that simplify UX and aggregate services, much like superapps in Web2 like WeChat or PayPal did for payments and social media. Solana’s high throughput and low latency make it an ideal backdrop for such an integrated experience, and Jupiter is capitalizing on that; from its mobile app that replicates a centralized exchange feel, to JupNet’s vision of abstracting away multi-chain complexity. Within this big picture, lending is crucial. It deepens user engagement as users who borrow or lend tend to stay and also trade, increases platform revenue as interest fees contribute alongside trading fees, and enhances Jupiter’s value proposition as a full-stack financial operating system.

Our forward-looking view is that Jupiter Lend will help Jupiter evolve from a leading Solana app into a foundational layer for all of DeFi. If Jupiter can continue to harmonize its services such as using JupUSD and cross-margin to tie together perps and lending, as discussed, it strengthens the flywheel effect driving JUP token value and Jupiter’s network effects. The project’s decision to allocate 50% of platform fees to JUP buybacks means that success in Jupiter Lend directly accrues value to stakeholders, reinforcing the incentive for the community to support growth across the stack. Solana’s DeFi landscape in early 2026 is maturing as total DeFi TVL is near $6.35bn, and Jupiter is positioning itself as the integrated “super app”. Its lending product doesn’t exist in isolation; it’s part of a holistic DeFi suite that could increasingly resemble a TradFi prime brokerage, but in decentralized form.

Overall, Jupiter Lend’s rise exemplifies how strategic partnerships can drive its growth. Its story is not just about TVL numbers, but about Jupiter’s strategic play to capture the full spectrum of user needs. Going into 2026, people should watch how Jupiter balances innovation with risk management. If the platform can successfully launch new features like JupUSD and JupNet while avoiding complications from its complex lending design, it will strengthen the thesis that a Solana superapp can exist. In that scenario, Jupiter, and JUP, could enjoy outsized network effects, making Jupiter Lend not just a one-off product but a key pillar of Solana’s financial infrastructure. However, if cracks appear, such as a liquidity event testing Jupiter Lend’s resilience or users balking at reduced yields, it would test the resilience of the superapp model. Thus far, Jupiter has shown an impressive ability to execute and adapt, but cautious optimism is warranted. Jupiter Lend’s early success is encouraging, but its true impact will be measured by how it propels Jupiter’s ecosystem forward and whether it can maintain momentum amid competition and risk. Overall, Jupiter Lend has set the stage for Jupiter’s next act; now the focus turns to delivering on the promise of an integrated, capital-efficient and user-centric DeFi experience that can carry Solana’s DeFi into its next growth phase.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.