Jito: Capturing the Economics of Solana at Scale

From staking to blockspace, this is how Jito turns Solana’s growth into revenue and tokenholder value.

Introduction

One of the lazier narratives in crypto is that tokens trade only on speculation because there’s no underlying cash flow to measure. Jito has been quietly disproving that idea. In under three years, the protocol has scaled to nearly $30 million in annualized revenue, putting it in the top tier of earners not just on Solana, but across the entire industry.

What makes Jito compelling is the breadth and depth of its business model, which is deeply ingrained in Solana. It doesn’t rely on a single revenue source, but captures value at multiple layers of Solana’s stack, from transaction flow via TipRouter, to liquid staking with JitoSOL, to its more recent push into BAM (block assembly marketplace). That diversification, combined with real institutional interest like VanEck’s proposed JitoSOL ETF, points to a protocol that we believe has staying power.

In this piece, we break down Jito’s revenue drivers, why TipRouter and Jito’s positioning around block building in particular sets it apart from other protocols, and how institutional adoption of SOL could harden Jito’s moat as Solana’s financial rails continue to mature.

What are Jito’s Revenue Streams Today?

TipRouter

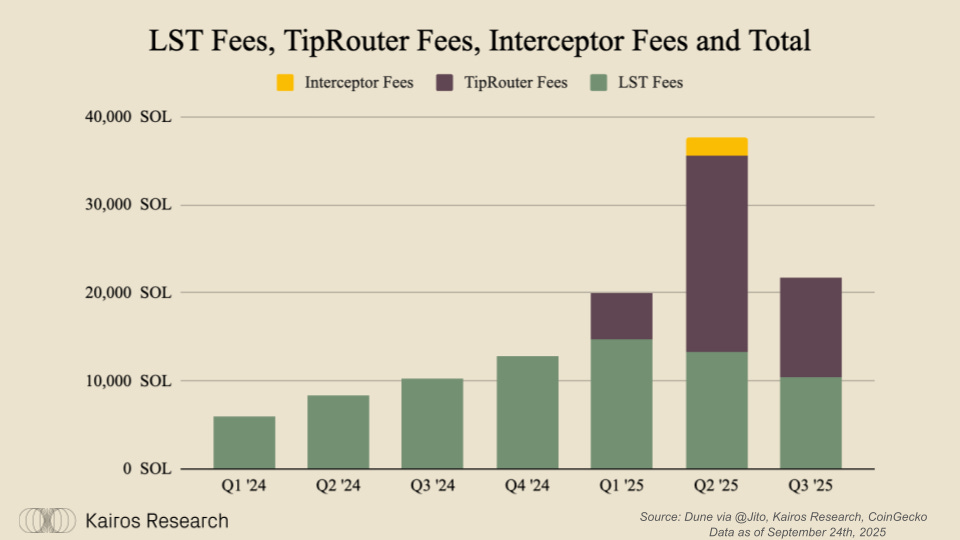

Out of Jito’s various revenue streams, one piece stands out above the rest: TipRouter.

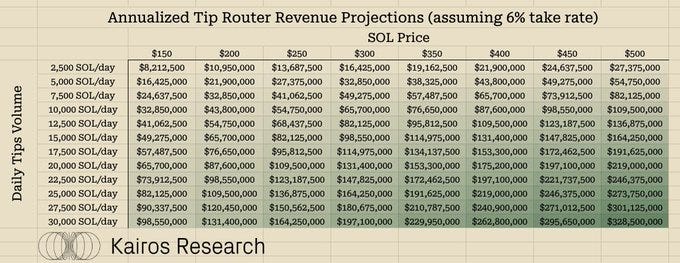

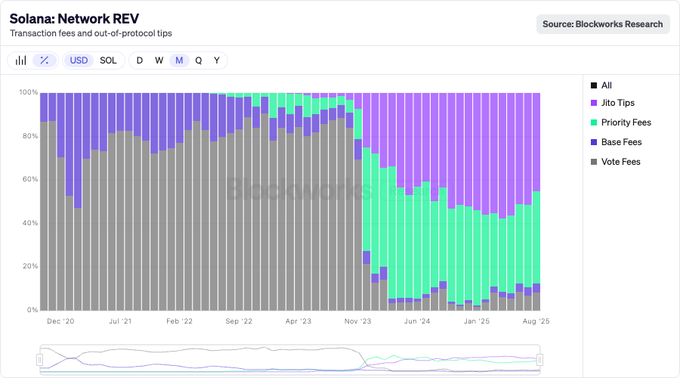

TipRouter is a distributed network of node operators (“Node Consensus and vaults (stakers) that decentralize Jito tip and block reward distributions on Solana. To understand TipRouter, you first have to understand what “Tips” are. Tips are akin to an in-house priority fee paid to validators, by users or applications, to prioritize their bundle of transactions (often 1-5 txns) in the block-building process. These tips incentivize validators to include specific transactions ahead of others within the same block. Timing and atomicity is everything, especially in markets, thus TipRouter is able to help Jito capitalize on the value created by its client software that allows priority access to the state of Solana. The protocol capitalizes on this via a 6% protocol take rate on all tips, paid in SOL.

JitoSOL

JitoSOL is Jito’s flagship retail facing product, it is the largest and most liquid LST (liquid staking token) on Solana. LSTs like JitoSOL provide users the ability to receive staking rewards they would otherwise forfeit, while mitigating a multi-day unstaking period and retaining the optionality of using their capital productively throughout DeFi venues like Kamino/MarginFi (lending), or on Drift as trading collateral. Jito has a modest take rate of 4% on staking rewards, as well as a 0.1% take rate for users who unwrap their JitoSOL, rather than trade it on the open market.

Interceptor

Interceptor is a mechanism designed to protect the JitoSOL stake pool from toxic-flow arbitrage-driven exploits by imposing a 10-hour cooldown on newly minted JitoSOL after SOL is deposited. This prevents actors from depositing SOL just before staking rewards (rebase) are applied, minting JitoSOL at the old exchange rate, and then instantly redeeming or swapping it at the new, higher value to capture unearned rewards. During this period, users cannot transfer or trade their JitoSOL unless they pay a dynamic fee, starting around ~1% and then linearly decreasing to zero over 10 hours for immediate access. This fee is intended to disincentivize opportunistic behaviors like depositing just before rebase events to unfairly capture staking rewards, and all fees collected go directly to Jito’s treasury, turning potential exploitative activity into protocol revenue.

Spotlight on TipRouter

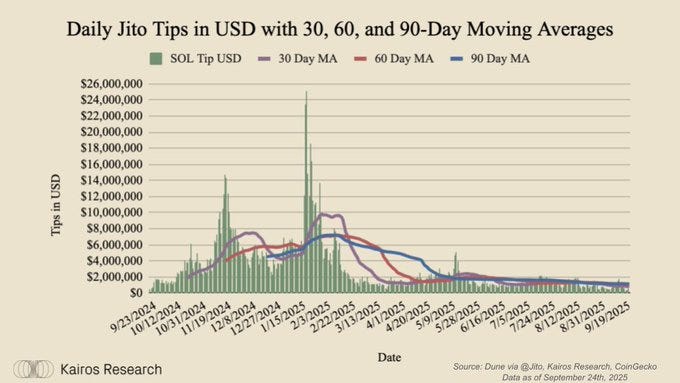

While JitoSOL has long provided a steady stream of income to the protocol, TipRouter has quickly become the dominant revenue driver, accounting for more than 50% of revenue across 21 of the last 32 consecutive weeks. So how does TipRouter capture all this value? The Jito DAO has a 6% take rate on all tips processed via TipRouter. These are then split in the following manner: 5.7% to the DAO treasury, 0.15% to restakers of JitoSOL, and 0.15% to restakers of JTO. Using the current 30-day moving average for Tips, results in $24.39m going to the DAO treasury annually, and $1.2m in additional real-yield distributed to restakers.

As seen in the chart below, Tips have become an increasingly important piece of Solana’s transaction flow. The more economic activity that takes place on the network, the more important timing and transaction ordering becomes for market participants - especially those looking for arbitrage across multiple venues.

However, while it is important to understand TipRouter and its history to get a better grasp on Jito’s overall path dependency as a protocol, understanding the importance of Jito’s newly announced Block Assembly Marketplace (BAM) paints a picture of the future of transaction execution on Solana.

Jito’s Evolution: Understanding Jito’s Block Assembly Marketplace (BAM)

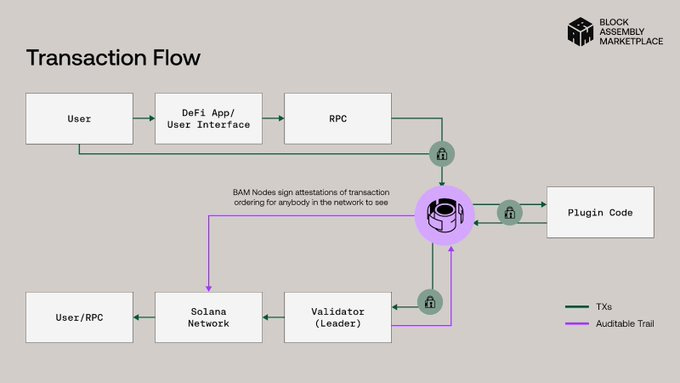

As the Solana network currently exists, only the validator that has been chosen for producing a block (the leader) is capable of determining transaction ordering within a block. The Block Assembly marketplace instead allows applications to flexibly customize their transaction sequencing with transparent ordering logic, which we believe is Jito’s most meaningful improvement for Solana to date. Why is it important for users? According to Helius, this alongside BAM’s “privacy-preserving architecture” aims to significantly reduce, if not eliminate, many of the most extractive forms of MEV, providing users with stronger execution guarantees and better pricing. Validators gain the ability to offer higher-quality execution, while developers and searchers can build directly on top of a new programmable layer of blockspace.”

In short, BAM is a high-performance block-building architecture that brings verifiability, privacy, and programmability to Solana’s transaction pipeline, paving the way for a new era of network adoption. The privacy preserving marketplace enables applications to monetize their user’s activity through giving them privileged access to backrunning arbitrage which can then be redistributed to the trader that placed the trade, liquidity providers or the DEX’s token holders.

An important issue to note is that a non-zero portion (mid single digits %) of Jito Tips stem from transactions that involve extractive MEV (Frontrunning, Sandwich attacks) - which has a real impact on validator profitability. In order to fully introduce BAM, validators will have to be convinced that it can lead to more consistent profitability. In the short term, adopting BAM and getting rid of extractive MEV + competitive internalized arbitrage should lead to lower upside volatility (during price insensitive periods like the memecoin craze) for both validators and the Jito DAO. All of this being said, we believe that it legitimizes the Solana network in such a meaningful way that the pie should grow enough to compensate for the lost revenue in the near future. Better and more transparent execution is a gigantic step towards bringing more real assets onchain, increased volume from sophisticated financial institutions and more activity for existing and future applications, which in any meaningful capacity should offset the fees currently earned from negative, harmful MEV. And lastly while we can not currently model out BAM fees, it is something we will do when there is real data to work with, as we anticipate that enabling additional functionalities for protocols via plugins helps apps keep more of their own value they generate, while reinforcing Jito’s positioning as a bet on Solana’s onchain activity.

Institutional Adoption

The VanEck JitoSOL ETF application is one of the clearest examples of institutional DeFi adoption. Crypto ETFs have proven to be successful products, with ~6% of the entire BTC and ETH supplies, a combined $183B, being owned through exchange traded products. Solana likely follows the same trend over time, signaling that SOL ETFs are around at least a $7B market in the near term. One of the largest economic downsides of owning the ETFs for assets like ETH and SOL, is forgoing staking rewards of 3 to 7%, respectively. The VanEck JitoSOL ETF would allow buyers to: 1.) Earn staking rewards around 7% and 2.) Avoid some of the complex tax repercussions that come with staking rewards.

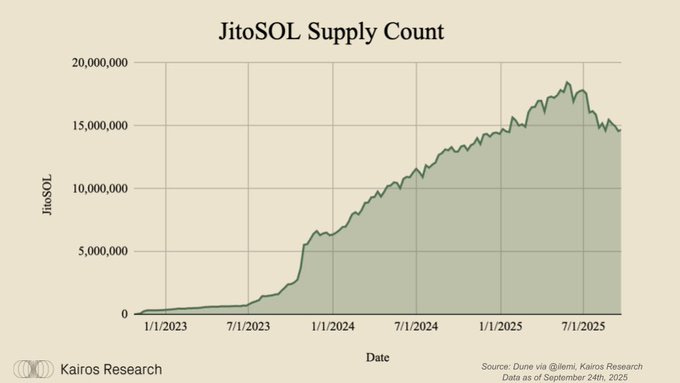

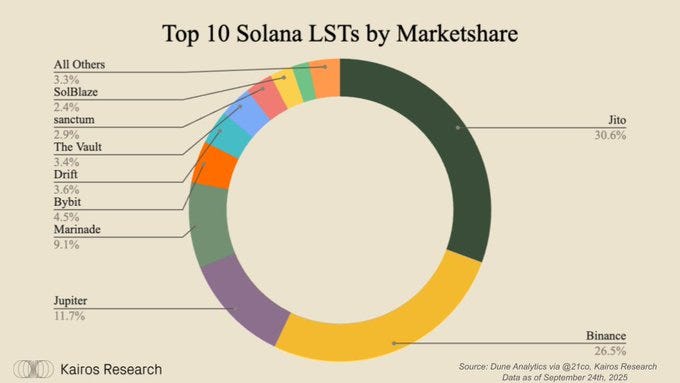

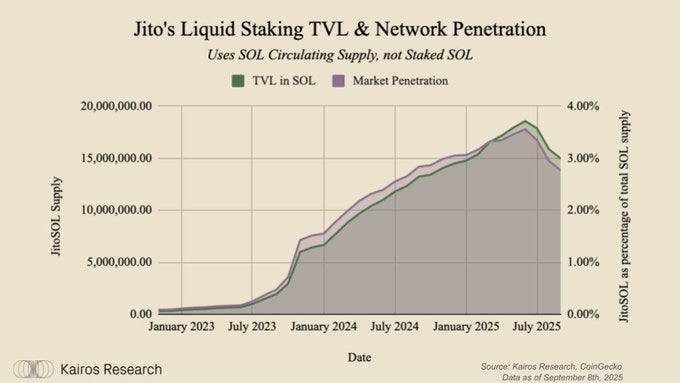

JitoSOL is such an integral part of any potential SOL staking ETF because it allows stakers to earn yield & avoid the ~3 day unbonding period of the network. Given an SEC requirement that 85% of net assets must be in highly liquid investments, vanilla staking would not be allowed. Other LSTs on the network would of course also be eligible, but JitoSOL is the largest (~40% of the LST supply) and most liquid ($200-600m in daily volume), both of which can be seen in the charts below. Additionally, JitoSOL has key integrations with exchanges and custodians like Coinbase, Kraken, Anchorage, Fireblocks, and Copper.

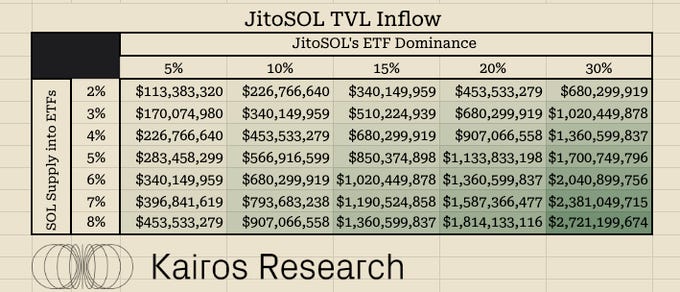

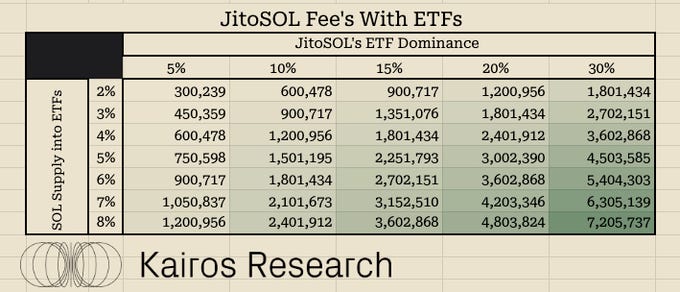

If JitoSOL market depth scales accordingly, at very reasonable estimates, staking ETFs could add $1-2B (30-60%) to Jito’s TVL. All else equal, every 10% increase in Jito’s TVL represents another $1.1M in annualized protocol revenue. Over time, we expect the liquid staking rate to increase and the ETFs to act as liquidity blackholes - so our estimates are very possibly on the low end.

Jito Outlook

As noted above, JitoSOL is the largest LST on Solana at 3.6% of the network stake & 2.7% of the circulating SOL supply. When you look at comparables like Lido on Ethereum (25.8% of staked ETH & 7.4% of the circulating supply), we can see that there is significant room for upside in market share. Additionally, Jito’s net income is already 55% greater than that of Lido’s when using Q3 data. A longer term goal for Jito’s saturation would be closer to ~15% of the network stake, which at current SOL prices would lead to another $30M+ in annualized DAO earnings.

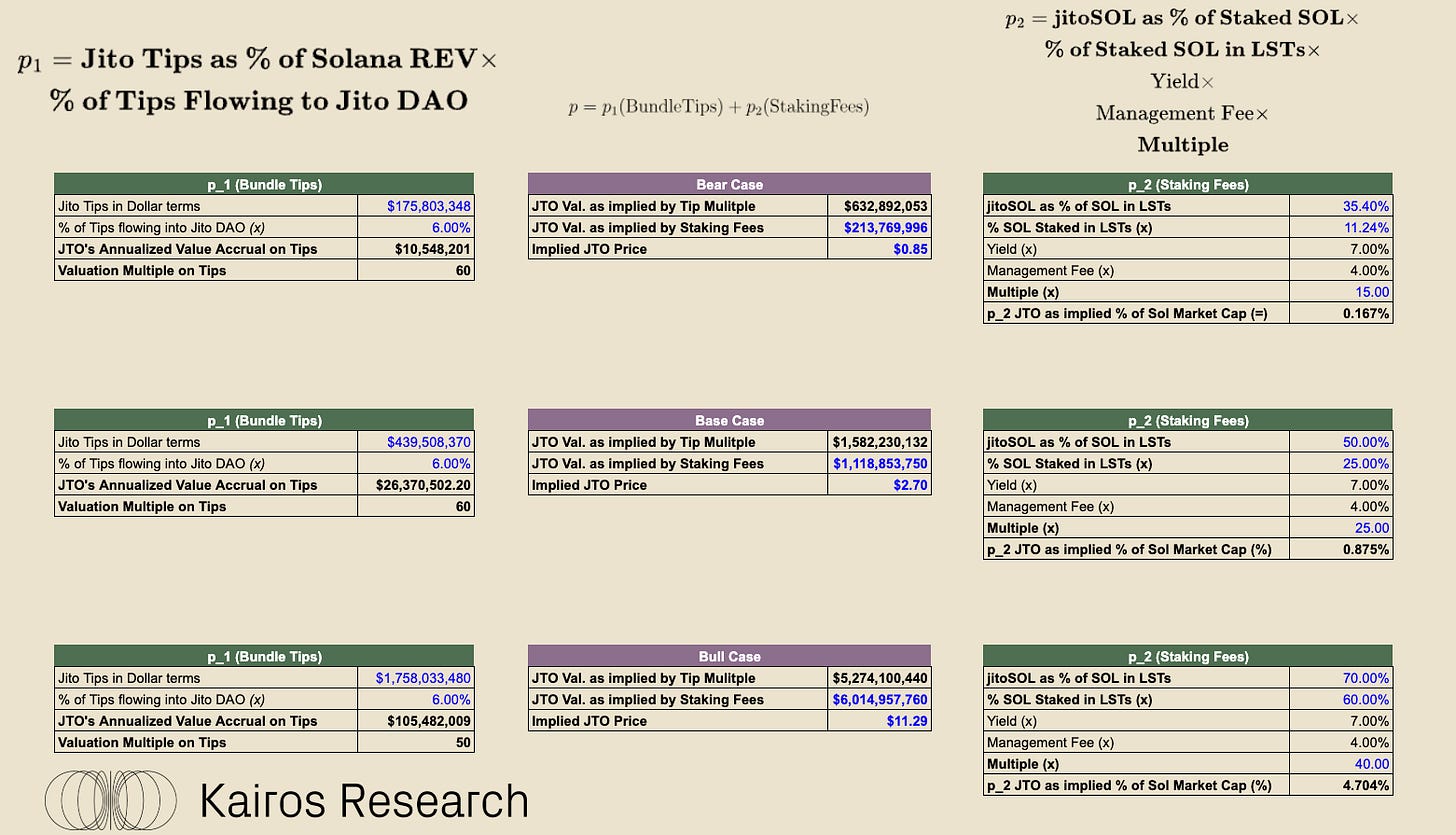

Below is a fork of Multicoin Capital’s JTO valuation model, in which we extrapolated upon the idea that JTO’s price is a function of Jito’s existing revenue lines, their potential adoption & differing growth multiples. We held the price of SOL constant and estimated 3 possible revenue scenarios for Jito, applying lofty earnings multiples to each scenario - based on the protocol’s rapid growth. This being said, we have seen Jito improve and expand their product offerings on several different occasions which should drive significant future value to the DAO.

Token Value Accrual

The token is an often overlooked part of the project. Many see it as an incentive mechanism to attract early users, but there are very few examples of projects properly accruing value back to the token itself. This is in part due to some nuances around protocols which have revenue going to the “Labs” entity, or an entity responsible for development of the protocol. This is largely understandable, but also takes away from fees that could ultimately flow to the protocol DAO itself. Jito recently changed this with the passing of JIP-24 which is now directing all of the block engine fees and any future BAM fees to the DAO treasury. This proposal also importantly notes that all funds will be earmarked to the crypto-economic subDAO which is tasked with transitioning the DAO towards a “multi-mechanism” approach to governing its token economy and connecting the economic bandwidth captured by the DAO to the JTO token. The desired outcomes are as follows:

An approach to ‘smart buy backs’

JTO or JitoSOL auction mechanisms

Mechanisms or approaches for enhancing JTO and / or JitoSOL liquidity

A DAO-to-DAO approach that enhances the network effects of JTO and / or JitoSOL

A Jito economy data and analytics system / oracle design

A JitoSOL / JTO yield augmentation mechanism

A fee switch vault mechanism

The DAO has already made progress here, having completed an initial token buy-back program worth $1m and has begun developing the Vault, JTO Auction, and Intelligent Buybacks, launched supporting analytics, and now plans larger buybacks, mid-term mechanism integration, and independent researcher coordination. The initial findings during the $1m buy-back indicated that JTO out traded SOL and outperformed market beta. Additionally, there was no evidence of frontrunning or adversarial market actors.

Conclusion

In conclusion, Jito stands out as the best possible way to express a directional view of Solana’s onchain activity and economic prowess, driven by TipRouter, BAM, and JitoSOL. Institutional adoption, highlighted by the VanEck JitoSOL ETF application, 8 spot SOL ETFs, and several $1bn+ digital asset treasury companies being announced, Solana is poised for its first large scale institutional wave, and Jito sits at the heart of it all. The CSD’s work to connect protocol revenues directly to JTO through buybacks and novel mechanisms signals meaningful progress toward tokenholder alignment. Taken together, Jito’s combination of product innovation, institutional credibility, and thoughtful tokenomics positions it incredibly strong in the current environment, with many positive tailwinds coming together, we are expecting it to outperform SOL across the next 6-12 months.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.