EigenLayer Spotlight: Witness Chain, The Real World & Verifiable Evidence

Witness Chain is turning real-world events into onchain truth.

Designing decentralized systems has required 15 years of careful experimentation around economic incentives to coordinate independent actors into consensus. Proof of Work, Proof of Stake and yield farming all used ~worthless~ tokens to encourage a global network of users to build blocks, store data, provide compute, supply liquidity and bootstrap blockchains. In 2022, Multicoin Capital took this basic idea and wrote a blog about “Physical Proof of Work,” echoing that these incentive mechanisms should be applied outside of just blockchains and instead used to incentivize human actions and the building of real world infrastructure.

If nothing else, crypto has become a global & instantaneous liquidity layer, where everybody in the world now has the ability to send funds anywhere at any time. On its own that is an amazing breakthrough in transaction efficiency, but how can it become world changing for humans and companies alike? We believe that by combining the concepts of Physical Proof of Work with the global liquidity layer, you can uniquely remove a layer of trust that is necessary in almost every aspect of both life and business.

A key roadblock in building this vision is establishing some form of proving mechanism that can examine any information put forth and verify its key aspects (i.e. is a photo / video real, was it submitted from a certain location, was it taken at a specific time). As AI improves and the lines between the real world and the digital world become increasingly blurred, it will be of the utmost importance that we are capable of large-scale and instant verification of real world events. Witness Chain’s most recent product addition, InfinityWatch, fully encapsulates this vision of “Verifiable Observation.” The consumer-facing piece of Witness Chain enables the verification layer to be established between blockchains, AI agents & humans on the ground.

Just giving the concept of a Verification Layer a bit of thought can generate multiple examples to how InfinityWatch could be utilized:

Disaster response AI agents crowdsourcing information from humans: Consider the possibility of humans submitting images and data for ongoing hurricanes or wildfires, that could accurately feed AI agents information about new flood zones, temperatures, wind speeds and rate of spread. The agents in theory would be able to outsource information gathering & better dispatch emergency response teams to the correct locations.

Marketing Campaigns requiring verified data from consumers: Imagine a company that is running a campaign to grow brand awareness, through sweatshirts or other merch - they could request that any recipients of the sweatshirts wear them at a conference / public event and submit a picture. In turn, the recipients would have their data verified and automatically earn some form of reward for their service.

News Focused Social Media: A new platform could require that any images or videos publicized by their users go through the verification process to avoid deepfakes and other forms of deception that will only gain in popularity over the next several years.

InfinityWatch relies on a mobile application & verification hardware combined with Proof of Location to guarantee that submitted data was produced at an exact location and timestamp. Combining data verification with trustless and automatic execution enables a leap forward in market efficiency of the digital economy, which likely marks a large step forward for companies and consumers alike. Kairos Research believes that many years down the road, verification could be used in everyday interactions. Whether that be a shipping company proving that a package was delivered or a septic company proving that they came to your house and completed their service, the consumer will receive assurance that a task was completed and the business could instantly receive payment once they have finished their job.

Protocol Design

Witness Chain is built as an Eigenlayer Actively Validated Service (AVS), bootstrapping the network’s economic security via the restaking of ETH and other ERC 20s. We have written extensively about the benefits that Eigenlayer and restaking provides to newly launched networks: providing applications the sovereignty & customizability that comes with app chains without needing to bootstrap their own validator set. In place of a validator set, Witness Chain utilizes Eigenlayer Operators for a key role, including:

Running Challenger Clients & creating proofs: Users are able to call on the Witness Chain Watchtower nodes (Operators) to challenge information: whether that be an image’s location, or a DePIN node’s location or capacity, etc

When launching a native Proof of Stake (PoS) system, you have to widely incentivize a new validator set to buy your nascent, volatile token and stake it to secure your chain. The end result is double or triple digit inflation of your token, massively diluting non-stakers, which can include network users, investors, the team and the treasury. By building on Eigenlayer, Witness Chain is able to leverage staked ETH as their primary source of crypto economic security. This allows the network's validators (stakers) to hold a relatively stable, battle tested crypto asset with near zero opportunity cost as it is simultaneously earning Ethereum’s staking yield. The general consensus is that the incremental yield that must be paid to restakers is magnitudes lower than what is required within a newly launched PoS network.

As of March 6, 2025, network rewards are not yet live so there is limited data on Witness Chain’s cost of security. However, Witness Chain has 114 Eigenlayer Operators live on the network composed of over 45.2k delegates. Across these delegates, a total of 3.79M ETH has opted in to secure Witness Chain - at current prices this is north of $8.5B in economic security.

Beyond crypto economic security, Witness Chain built their Real World Verification Engine using the Polygon Chain Development Kit (CDK). According to a Tweet from the Witness Chain team, this provides key benefits across:

Security: Proofs created by Witness Chain settle to Ethereum mainnet

Interoperability: These proofs can be natively shared across other Polygon CDK chains

Customization: Gasless transactions

In the next section, we will break down the mechanics behind Witness Chain’s core products and how they can be applied to users and the existing crypto landscape.

Campaign APIs

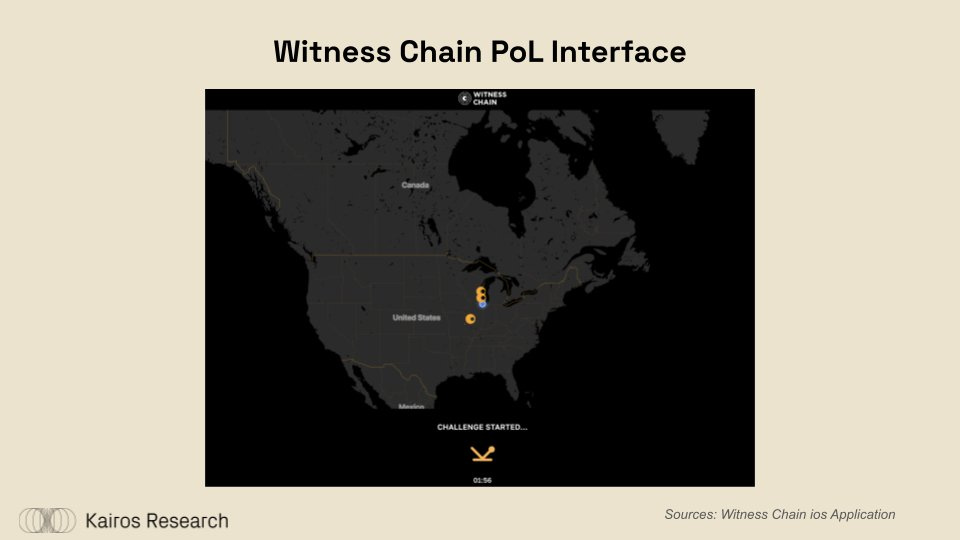

Through the Witness Chain application, developers are able to create campaigns in which they can request crowdsourced, geo-verified images & reward (not yet live) anyone that submits them. Powered by the Proof of Location mechanism described below, these campaigns can be designed to only take submissions from certain geographic areas at certain times. While we ran through a number of examples of how InfinityWatch could be used, we recommend diving into the longer list of examples provided in Witness Chain’s documentation. Before submitting an image, the application runs a challenge to determine your location as seen in the image below.

Proof of Location

Decentralized networks are composed of “mutually non-trusting” participants (nodes) that are responsible for verifying that the other parties are acting truthfully and in accordance with the best interest of the network. In DePin networks, the location of these nodes is often critical to the functioning of the product and it must be possible to verify that they exist in the actual location they are submitting to the network.

Witness Chain creates their location proofs using cryptographic UDP Pings to measure the connectivity timing delay between the network participants, such that it can measure an accurate distance between each of the active nodes all without being susceptible to VPN and proxy spoofing. Once the locations have been measured, Witness Chain puts forth a challenge that states a maximum distance the node can be from where it previously communicated & the proof is then returned to the network.

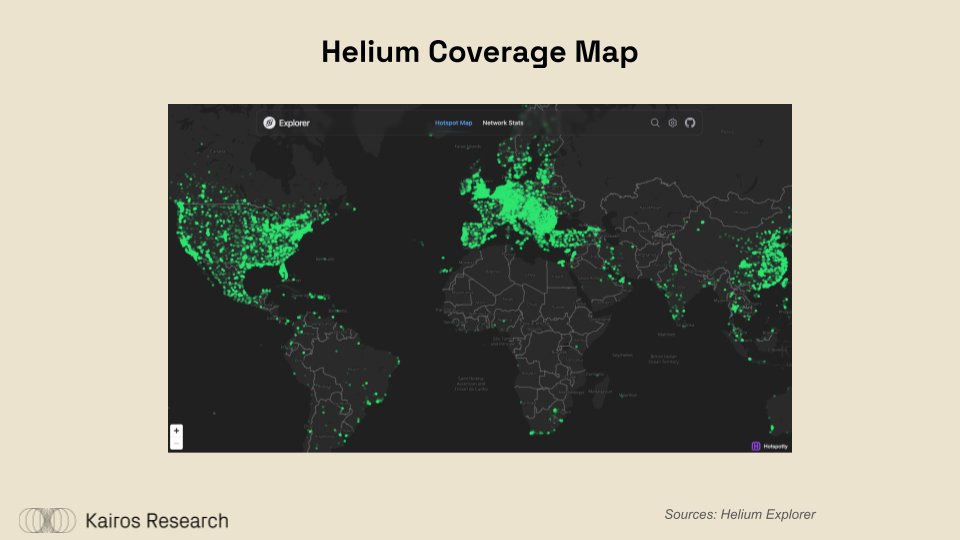

Connectivity networks, for example, are attempting to provide global, distributed connectivity so they desperately need their nodes to be globally distributed. If node operators were able to spoof their location and trick the network into believing they were providing connectivity in a typically underserved area - they may be able to earn outsized token rewards & trick consumers of the product into believing the network has more coverage than it really does. While certain DePIN networks like Helium (map below) already have in-house solutions for proving geolocation, this requires specialized, non-Byzantine Fault Tolerant hardware specific to each network. Given all of this, the broader concept of Witness Chain can be easily extended to both newly bootstrapping networks or to networks that want to opt into a more widely standardized form of proving.

We recently wrote a piece about how Akash & other protocols, including Spheron, a Witness Chain partner, are looking to decentralize the global compute market, such that anyone with un-utilized computing resources can resell them in an open, permissionless manner. If these networks were to utilize Witness Chain’s Proof of Location, buyers could be acutely aware of where they are purchasing their computing power, such that they know if they have sufficient geographic diversity or if they can purchase cheap compute while still following their jurisdiction’s regulations (OFAC, etc). While this is theoretical, the Akash network could also use Proof of Location to effectively incentivize suppliers in certain jurisdictions. Using token incentives aimed at specific regions would be a target for VPN style manipulation, but with effective triangulation a network could properly identify where these data centers and nodes are located.

Witness Chain provides a number of other scenarios for how its users can potentially utilize their Proof of Location.

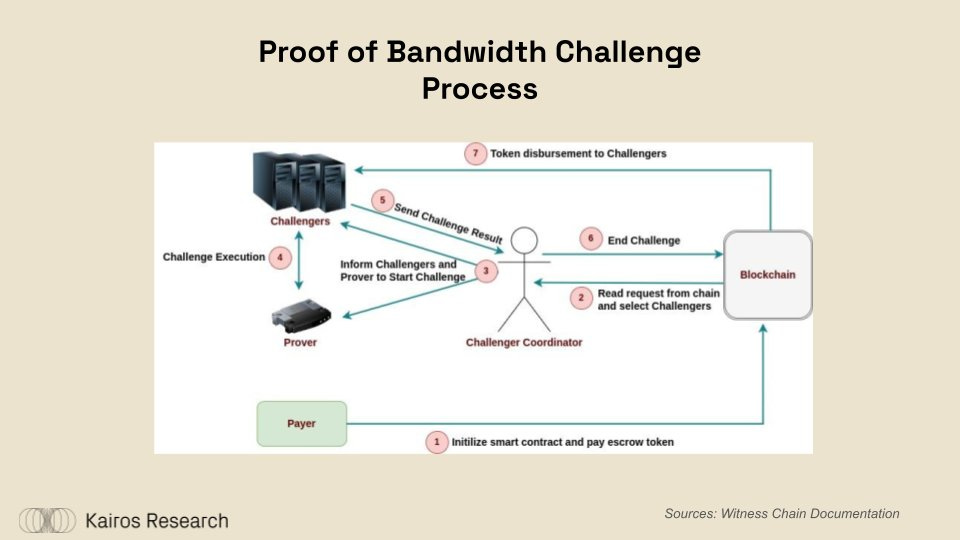

Proof of Bandwidth

In a similar vein to Proof of Location, Proof of Bandwidth allows ANYONE to effectively measure the backhaul capacity of a DePIN network’s resource suppliers. Understanding the true capacity of a DePIN network, especially in storage, energy & compute, is an essential characteristic of a marketplace. As seen in the image below, somebody that challenges a node's backhaul is a “payer” and they put forth the capital necessary to test the full capacity of that service provider for a short period of time. The network then watches if the node is able to fulfill its stated capacity & records the result to the blockchain.

By bringing further transparency around node capacity, Witness Chain allows:

DePIN Network’s to:

a.) Properly allocate incentives to large & important suppliers

b.) Punish nodes that are misrepresenting capacity

2. Users to:

a.) Accurately estimate if there is sufficient supply for their demand

b.) Properly gauge the price of their required demand

As mentioned in the sections above, this transparency is a major key to creating financial markets around these decentralized resources. Not only in the sense of users paying upfront for future capacity, but also in the way that networks reward their resource providers - given that bootstrapping supply with token incentives is often a key step BEFORE finding real demand.

Witness Chain undoubtedly has the potential to add value to a wide range of more traditional industries & DePIN networks, as shown throughout the entire report, however, two of our main questions are explored below:

How does Witness Chain effectively onboard users to the demand side?

The roadmap to onboarding non-crypto native companies will likely be a long term vision, but it could clearly prove worthwhile. In the shorter term, we could easily see social media applications being enticed to use Proof of Location and Timestamps throughout their interfaces to generate an increase in user trust. The next step will be for them to understand why they should use crypto native solutions for verification & The examples of disaster response also seem like a no-brainer integration for local governments as they become informed about the potential of InfinityWatch. The grand vision of a wide variety of industries tapping into InfinityWatch may be years away, but friendlier crypto regulation & increasing comfort around stablecoins as a form of payment will make the sales pitch far more feasible.

We also believe that Witness Chain presents tremendous opportunity for crypto native protocols that will likely be the earliest adopters. For a couple examples:

a.) Protocols that want to tap into the global liquidity networks (i.e. Bitcoin, Ethereum, Solana, Tron), but require some form of on-chain compliance that can enforce decentralized policies via Proof of Location. 0xPredicate is utilizing PoL to build natively geo-fenced transactions, which can massively improve fair incentive distribution and compliance with laws across multiple jurisdictions.

b.) Newly launched & upcoming DePIN protocols that have yet to build out their own solutions for testing node location and bandwidth. By opting in to Witness Chain, developers can outsource a huge technical lift and focus on improving their own core products. However, there are a number of very successful DePIN protocols that have already advanced beyond their protocol design stage - how can Witness Chain get them interested in utilizing InfinityWatch?

2. How does Witness Chain monetize their product and accrue value?

Kairos finds it very likely that companies, governments and crypto networks would pay a premium for verifiable, accurate data especially if it is verified in a rather provably transparent manner. Witness Chain could become an effective connector sitting between real-world data and on-chain protocols and it is very possible that they could get a first mover advantage on anything related to proof of location, timestamps, bandwidth and more. As of today, Witness Chain plans to monetize via on-chain transaction / gas fees - but we believe in the future it will be increasingly possible to take a small spread on any campaign proceeds and economic outcomes enabled by Witness Chain’s data verification.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.