Could TIA Become Deflationary?

From inflation to scarcity: the potential evolving economics of Celestia

Could TIA Become Deflationary?

Executive Summary

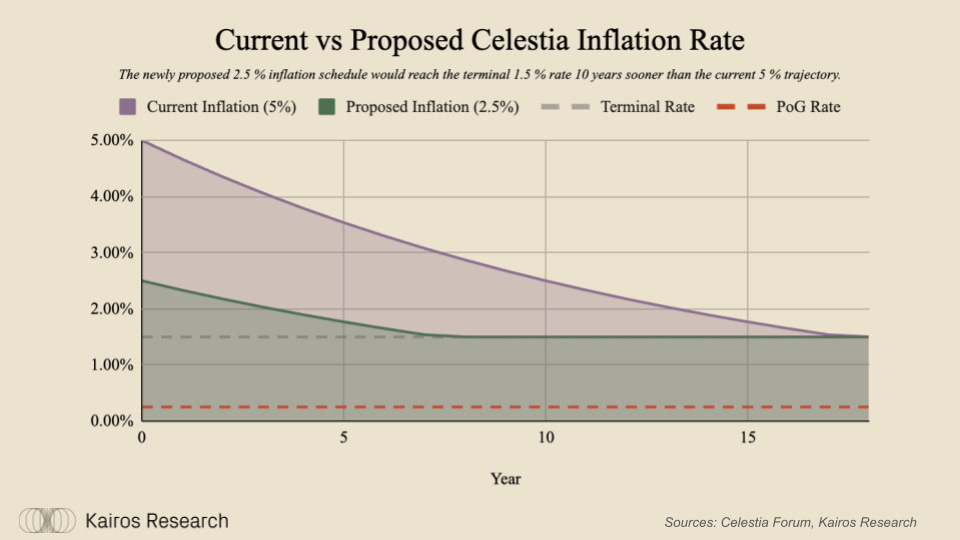

Celestia’s native token TIA has a dynamic supply outlook that could potentially turn net-deflationary under the right conditions. In essence, if data availability (DA) fee revenue and other fees on Celestia grows large enough to outpace new token issuance, TIA’s net supply could stop rising and even begin to shrink. At present, TIA’s monetary policy is inflationary at around 5% annualized, but this rate is programmed to decrease over time and can be further adjusted through governance. In fact, an upcoming network upgrade will halve the inflation rate from 5% to 2.5%, cutting roughly 29 million TIA of yearly issuance. Additionally, an even more radical framework known as “Proof-of-Governance” (PoG) has been discussed, which could lower inflation to just 0.25%. Our break-even analysis shows that at the current 5% inflation, Celestia would need an extremely high level of DA usage, on the order of terabytes of data posted per day at today’s fee rates, for TIA to become deflationary.

However, if inflation is reduced and network adoption is strong, the gap between fee revenue and issuance narrows quickly. In optimistic scenarios, net TIA issuance could approach zero or turn negative, meaning network fees generated by rollups and applications using Celestia for DA would offset or exceed the newly minted TIA. We modeled different scenarios under varying assumptions to evaluate how rollup adoption, application demand, and fee levels influence net issuance. This trend is already taking shape; in July 2025 the network saw a 33% cut to TIA’s inflation, and further measures are being pursued to improve token economics. Overall, while TIA remains inflationary today, the combination of growing DA and other fee revenue coupled with proactive monetary governance could transform TIA into a deflationary or near-zero-inflation asset. This would enhance its value proposition for long-term investors and participants in the Celestia ecosystem by aligning token supply with actual network usage.

Introduction

This report examines the conditions under which TIA could transition from an inflationary token to a deflationary asset. The core hypothesis is that if Celestia’s data availability fees, aka the payments for posting blobs of rollup data, eventually surpass new token issuance, then net TIA supply growth will halt or reverse if fees are burnt. This analysis is grounded in Celestia’s role as a provider of scalable data availability to rollups and app-chains. Like many layer-1 networks, Celestia currently uses token inflation to reward validators for securing the network. However, high inflation without commensurate network usage is unsustainable because it dilutes token holders and puts downward pressure on TIA’s price through validators and stakers selling. Celestia’s long-term vision should therefore be to transition away from staking, validator rewards, inflation and instead aim toward overhauling issuance to a minimum viable amount , and burn fees generated by actual network usage, all of which are being considered under PoG.

To explore TIA’s deflationary potential, we will cover the following points:

Current Inflation Model and Break-Even Fees: Reviewing TIA’s inflation schedule and estimating the fee revenue required to offset various inflation rates.

Data Demand Scenarios: Modeling data availability demand and fee revenue under different adoption scenarios - from low usage to aggressive rollup growth.

Issuance Dynamics: Examining how token issuance incentivizes validators today and how growing protocol revenue could reduce reliance on inflationary rewards.

Governance Flexibility: Assessing Celestia’s on-chain governance and its ability to adjust monetary policy (e.g. lowering inflation, introducing fee burns or new frameworks like PoG).

Ultimately, this report provides our perspective on how TIA’s monetary profile could evolve if Celestia’s ecosystem growth and governance initiatives succeed.

Primer on Proof-of-Governance

One of the core scenarios examined within this report is “Proof of Governance” which within the paper is abbreviated as PoG. PoG was first introduced via a governance forum post from John Adler, one of the co-founders of Celestia, which pragmatically examines proof of stake economics in their current form. The idea, if accepted by the community in its current form, would get rid of staking all together, cut inflation to just 0.25%, and have the remaining issuance be distributed directly to the validators, and burn all real economic value (REV). We personally believe PoG positions Celestia for success. As Celestia blocks continue their march towards 1gb size, the design parameters for users widen, and at that block size, even modest consistent block space utilization would make TIA net deflationary.

Primer on the Matcha Upgrade

The Matcha upgrade scales block size up 16x to 128MB with a new high-throughput propagation mechanism, halves inflation to 2.5% while raising validator commissions to 10%, and removes token restrictions to make Celestia a routing layer for any asset. It also shortens the unbonding time by 7 days (approximately 33%) and trusting periods by half, and introduces pruning changes that drastically cut node storage costs. Together, we believe these changes strengthen scalability, cross-chain utility, and TIA’s monetary properties while preparing the network for a potential PoG centric future.

Break-Even Analysis: TIA Inflation vs. DA Revenue

TIA’s Current Inflation Model: Celestia’s monetary policy began with a relatively high inflation rate to bootstrap the network. At launch in late 2023, TIA inflation was set around 8% annually on a 1 billion initial supply. This rate was programmed to decay each year by roughly 10% of the rate per year until it reached a terminal rate of approximately 1.5%. In July of this year, Celestia implemented CIP-29 as part of the Lotus upgrade, which accelerated this process by cutting the inflation rate by one-third. Inflation dropped from about 7.2% to 5.0%, and the decay schedule was adjusted to reduce the rate by 6.7% each year going forward. As of today, TIA inflates at roughly 5% per year and will gradually decline to 1.5% over time absent further changes.

In concrete terms, with a circulating supply in the 1.1-1.2 billion range, about 55 million new TIA are currently issued annually. Lowering the base inflation rate dramatically reduces the amount of new TIA entering circulation each year. For example, at 5% inflation Celestia mints around 55 million TIA per year; halving inflation to 2.5% would create only roughly 28 million TIA per year, and at the future baseline of 1.5% the issuance would be roughly 16-17 million TIA.

In an extreme scenario of 0.25% inflation under a PoG model, annual issuance would drop to under 3 million TIA, essentially a negligible increase relative to the total supply. These figures illustrate how sensitive TIA’s supply growth is to the inflation parameter.

Break-Even Fee Requirements: For TIA to become net deflationary, the fees collected from data availability and other transactions must offset the annual token issuance. Because Celestia’s block space has a fixed maximum capacity, there is an upper limit to how much data, and thus fee revenue, can be posted per day unless block parameters are expanded. Under current parameters, Celestia’s block size is 8 MiB approximately every 6 seconds, which translates to a maximum of roughly 115,000 MiB per day, or about 112.5 GiB/day of data posting. Using present fee levels, we can estimate how much daily usage would be needed to cover different inflation rates:

5% inflation: Not attainable barring unrealistically high usage (it would require on the order of 2.5 TB of data posted per day at current fee rates).

2.5% inflation: Similarly unattainable under current conditions (would need roughly 1.25 TB of data per day, far above today’s demand).

0.25% inflation: Potentially achievable, but only if the network is near full capacity. In practice this means hundreds of gigabytes of data daily (and likely higher fees per byte) to offset even this low inflation rate.

For perspective, roughly 2.5 TB/day of data posting would generate roughly $90 million in fees per year, enough to cover 5% inflation, and about half that (1.25 TB/day) would cover a 2.5% inflation, illustrating how extreme usage must be to fully offset current issuance. Clearly, with today’s parameters Celestia would need an almost unrealistically high throughput to achieve net deflation from burning DA fees alone. For further context, 2.5 TB/day of data is roughly equivalent to 10-12 million typical Ethereum transactions worth of data each day, an extremely ambitious load for any blockchain.

There are reasons to believe this gap can narrow over time. First, Celestia’s inflation is not static; as we already mentioned, governance is actively exploring a reduced dependence on inflation and shift towards burning fees as the main source of network value accrual. Second, demand for blob space can rise if more rollups and data-intensive applications launch on Celestia - a trend that we should likely bet on if we believe that crypto will be successful in the long term. Celestia offers significantly lower data costs for rollups compared to using monolithic chains.

Third, as block space demand increases, market forces could drive fees per byte higher from today’s ultra-low levels, similar to how Ethereum’s gas fees rose when demand spiked during DeFi and NFT booms. Celestia’s design allows throughput to scale by adding more nodes via data-availability sampling, but there are still practical bandwidth and storage limits. If those limits are approached, the price per unit of data would almost certainly rise, and given how much cheaper DA currently is than on Ethereum, Celestia should have significant pricing power. In summary, the break-even analysis indicates that TIA becoming deflationary is challenging with current usage and parameters. However, the gap between fee revenue and issuance will shrink if inflation is lowered and if Celestia captures even a fraction of the adoption its low fees are aiming to attract.

DA Demand & Revenue Modeling

To better understand how usage translates into fee revenue, we modeled several data demand scenarios for Celestia and their impact on TIA’s net issuance. For these estimates, we assume a baseline fee rate and consider both static fees and a case where fees increase as blocks fill up, reflecting some price elasticity.

Currently, fees are extremely low, roughly 0.022 TIA per MiB, about $0.10 per MB. Given that daily usage is presently low on the order of only a few gigabytes per day, fees per byte are minimal. With the 8 MiB block size limit, daily DA capacity is about 112.5 GB/day. That is the maximum volume unless block sizes are increased in the future. In other words, beyond a certain point, additional demand will push fees up rather than increase the number of bytes posted.

Usage Scenarios

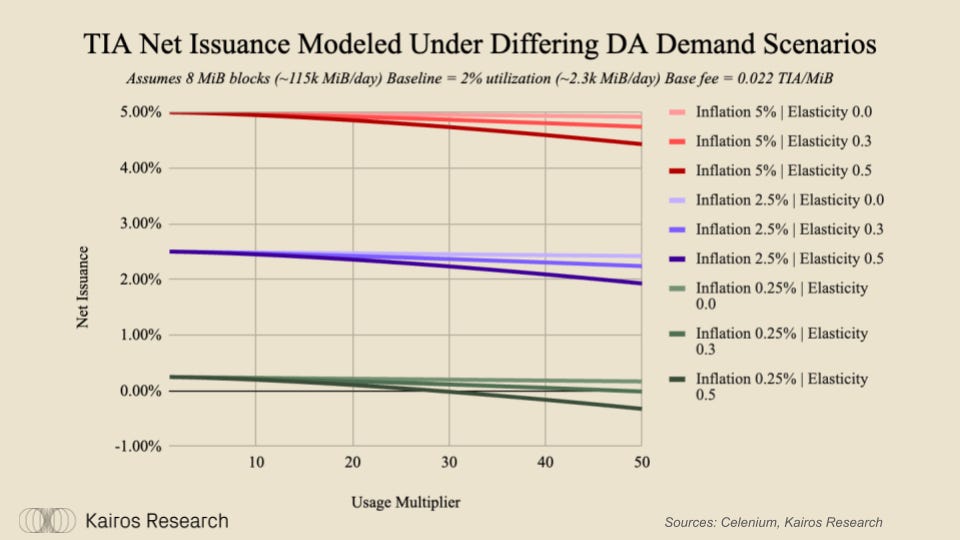

We model daily data usage relative to a current baseline of 2,300 MiB/day (2.3 GB/day), equivalent to 2% utilization of the 8 MiB block limit. From this baseline, we scale usage in multiples and test under different inflation and elasticity assumptions.

Current (Baseline):

At 2.3 GB/day, annual fee burn is negligible, <0.1M TIA, compared with approximately 57M TIA of yearly issuance at 5%. Even under the lowest modeled inflation of 0.25%, usage at baseline falls far short of offsetting issuance assuming fees are burnt.

Moderate Adoption (10-20x baseline):

At 23-46 GB/day, annual fee burn rises into the low single-digit millions of TIA, still covering less than 10% of 5% issuance. However, at 0.25% inflation, elasticity (represented as ε) begins to matter. With ε = 0.5, net-zero issuance could be achieved around the upper end of this range.

High Adoption (50x baseline):

At 115 GB/day, the system is effectively at the 8 MiB block cap. At flat fees, this generates roughly 900k TIA annually, far below what is needed even at 0.25% inflation. With elasticity, fees rise as blocks fill: under ε = 0.3, break-even against 0.25% inflation occurs almost exactly at this point (113k MiB/day). With ε = 0.5, break-even arrives sooner (65k MiB/day, 28x baseline), meaning net zero issuance is possible before max capacity if demand drives prices higher.

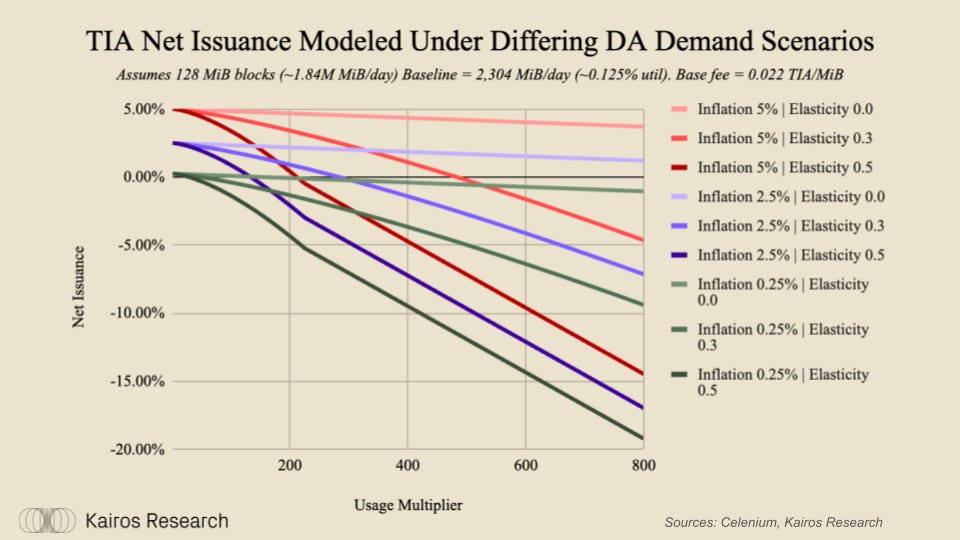

Aggressive (Beyond 8 MiB Blocks):

When block sizes increase to 128 MiB in the upcoming network upgrade, daily capacity would scale from 115,000 MiB to 1.84m MiB, raising the ceiling by approximately 16 times. The baseline remains fixed at roughly 2,300 MiB/day, so the break-even multiples in “x baseline” terms do not change: net-zero issuance under 0.25% inflation is still achieved at 28-49x baseline depending on elasticity. The difference is that with 128 MiB blocks, this break-even point now sits well below capacity. Put differently, instead of brushing against the ceiling, Celestia could sustain net-zero issuance at much higher absolute volumes without congestion. Under 2.5% or 5% inflation, however, break-even remains unattainable even at expanded capacity.

Takeaways:

At 5% and 2.5% inflation, net-zero issuance is unattainable under realistic, short term conditions, even with fee elasticity.

At 0.25% inflation, net-zero issuance is feasible if demand rises by 30-50x current levels and elasticity drives higher effective fees per MiB.

The binding constraint at 8 MiB blocks is bytes, not demand; expanding block size to 128 MiB relieves this ceiling but does not change the break-even multiples required.

Drivers of Demand: The obvious primary way to increase DA fee revenue is by growing the number of rollups and chains using Celestia. In particular, data-heavy applications with frequent state updates such as high-frequency trading apps could generate substantial data. Additionally, entirely new classes of applications could emerge precisely because Celestia makes posting large amounts of data economically viable; decentralized apps that were impractical on expensive monolithic chains might flourish when data costs are drastically lower - however, this is yet to be proven.

Staking and DeFi Implications: If TIA’s inflation is reduced, or if staking is completely removed in a PoG scenario, many tokens would circulate in the broader ecosystem rather than being locked up purely for staking rewards. The elimination of staking rewards could serve as a forcing function to increase TIA’s utility in DeFi and generally boost demand for the token. Over time, rollups may also adopt TIA for gas fee payments.

Lazy bridging has the potential to make TIA the common settlement asset across Celestia’s rollup ecosystem. By enabling seamless rollup-to-rollup transfers, it drives frequent movement of TIA for trading, liquidity, and collateral purposes, embedding the token into various applications. This activity may also boost blob posting on Celestia as proofs and messages are relayed, directly increasing DA fee burn.

The dynamic can potentially become reflexive as well: as DA fees rise with utilization and burn offsets issuance, TIA accrues greater value, strengthening its utility in DeFi. In turn, wider adoption of TIA across rollups amplifies inter-rollup flows, leading to more blob demand and higher fees on the Celestia main chain. Under low-inflation regimes, this loop materially accelerates the path to net-neutral or deflationary issuance, potentially making lazy bridging a structural driver of both TIA’s utility and monetary tightening.

Issuance Dynamics & Token Economics

Turning to the supply side, we analyze how TIA’s issuance works today and how it might change as Celestia’s fee revenue grows.

Role of Inflation Today: Celestia is a proof-of-stake network built with the Cosmos SDK, so it uses inflationary token issuance to reward validators and delegators. New TIA tokens are minted with each block and distributed as staking rewards, with a small portion allocated to a community pool for ecosystem funding. This model is typical for emerging PoS chains: high inflation in the early years helps bootstrap “security” by providing strong incentives for token holders to stake and validators to operate infrastructure.

In Celestia’s case, the initial 8% inflation was programmed to decay to 1.5% over time and was intended to gradually reduce dilution. Governance can adjust these parameters, as demonstrated by CIP-29’s reduction of both the base inflation and its decay rate. As of mid-2025, roughly half of all TIA was staked, yielding an annual percentage rate (APR) for stakers in the low double digits. This generous yield helps “secure” the network but comes at the cost of diluting non-staking holders and creates constant sell pressure, since many validators must sell a portion of rewards to cover costs or take profit. These factors are a key reason that many layer-1 communities seek to lower inflation. Unjustifiably high inflation and dilution in early stage protocols can discourage key stakeholders (core team & investors). We believe that cutting TIA dilution as rapidly as possible lengthens the runway required to attract significant demand & build a sustainable ecosystem.

Network upgrades can cut inflation directly (already reduced once, with a further upcoming cut to 2.5% imminent), lowering new supply. Fee burns could further offset issuance by permanently removing TIA as DA usage grows. Proof-of-Governance (PoG) combines these levers, replacing staking rewards with minimal inflation of 0.25%.

Taken together, these measures show a clear trajectory: TIA’s net issuance is set to decline as adoption rises. If usage grows meaningfully, Celestia could approach a near-fixed or even deflationary supply, strengthening TIA’s long-term value proposition.

Governance and Monetary Flexibility

Celestia’s ability to realize these tokenomic improvements hinges on its governance system and the flexibility built into its protocol rules. Here we consider how Celestia’s governance works, what tools it has to adjust economic parameters, and how its approach compares to other blockchain ecosystems.

Celestia’s economic policy can be adjusted via its on-chain governance, which is modeled after other Cosmos-based networks. TIA holders, through their staked tokens or delegations, are able to vote on proposals that modify network parameters or upgrade the protocol. This system gives the community the tools to fine-tune monetary variables such as the inflation rate, min or max validator commission, etc. Indeed, we have already seen it in action: as mentioned previously, with the Lotus upgrade (CIP-29) passing in July, inflation was cut from 7% to 5%, and there is an active proposal to halve it again to 2.5%. These changes indicate that stakeholders are engaged and willing to support adjustments to improve TIA’s value accrual. In general, any measure, from lowering inflation to introducing fee burns to even restructuring the validator incentive model, as with the PoG proposal, can be implemented if it gains sufficient support. This flexibility, built into the protocol, means Celestia can respond to economic conditions and community priorities relatively quickly versus other networks.

Compared to some other blockchains, Celestia’s approach to tokenomics has been proactive. Ethereum, for instance, took multiple years and major updates (the EIP-1559 fee burn & the Merge’s issuance cut) to achieve a low-inflation, periodically deflationary status for ETH. Newer chains like NEAR are only now considering reducing their inflation because usage has lagged, and chains such as Solana have been more static with their emissions so far. On the other hand, networks like Tron and BNB Chain have aggressively used fee burns or token buybacks to curb supply growth, though those mechanisms are often centrally coordinated.

Celestia stands out for exploring significant economic reforms within its still nascent existence; we especially think the PoG exploration is noteworthy. This mindset demonstrates a strong commitment by the team and community to make TIA economically sustainable. Of course, any bold change must be balanced with maintaining awareness of respective tradeoffs. The debate around the 2.5% inflation cut, for example, included comments cautioning falling validator profitability. Overall, Celestia’s governance has shown both the will and the means to steer TIA’s monetary policy toward greater scarcity. As long as the community remains aligned on the long-term vision, this governance agility should help Celestia optimize its token economics without compromising its core security and decentralization.

Conclusion

Our analysis shows that TIA can potentially transition from an inflationary token to a deflationary, or near zero-inflation asset under the right conditions. Achieving this would require a combination of strong network usage, primarily via DA usage, and strategic monetary policy adjustments. At the current levels, around 5% inflation and relatively low usage, TIA’s supply continues to grow each year, though the programmed decay will gradually lower that inflation rate. Simply put, fees from today’s activity are nowhere near enough to offset issuance.

However, if Celestia’s adoption increases substantially, for example if many rollups and applications use it such that hundreds of gigabytes of data are posted daily, and if inflation is concurrently reduced to 2.5% or even lower, then the balance shifts. Under those optimistic conditions, the fees generated by the network could equal or exceed new token issuance, flattening TIA’s net supply growth. Celestia’s governance is actively moving in this direction: it has already cut the inflation rate by one-third and is considering further cuts to 2.5%, with even more drastic options like PoG’s 0.25% inflation and a fee burn mechanism on the table. These measures, along with growing usage, provide a realistic path for TIA’s net issuance to approach zero or turn negative in the coming years.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.